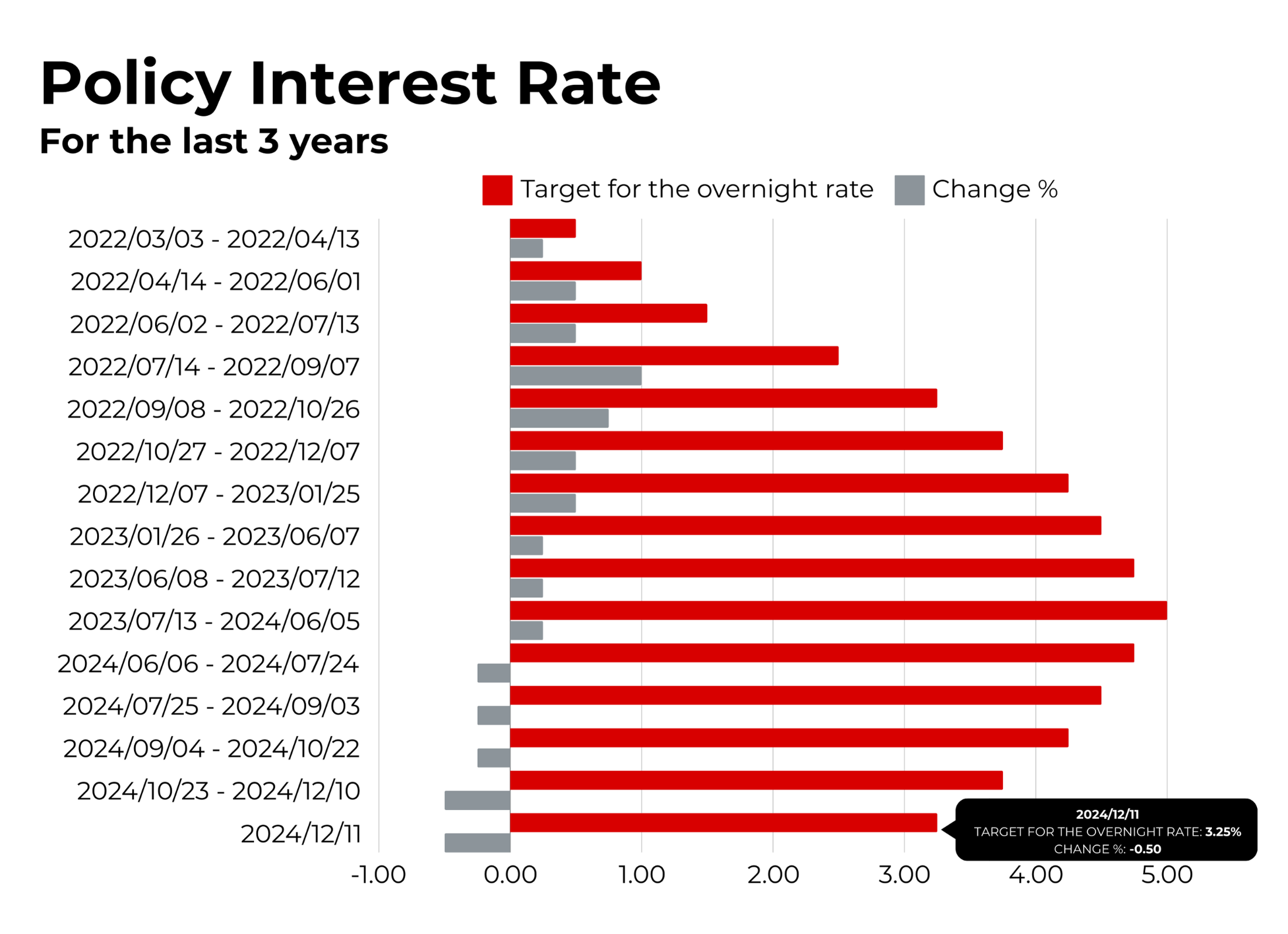

On December 11, 2024, the Bank of Canada announced a 0.50% cut to its key interest rate, bringing it down to 3.25%. This marks the fifth rate cut since June. While the reduction is significant, the Bank has signaled that the pace of future cuts will likely slow.

Why It Matters

Interest rate changes influence many aspects of the economy and personal finances. Here’s what this latest adjustment could mean for you:

Lower Borrowing Costs: Big banks like TD, RBC, and others have already reduced their prime rates to 5.45%, which can make borrowing more affordable for mortgages, car loans, and personal loans.

Real Estate Impacts: Lower rates may make it easier for buyers to qualify for mortgages, potentially boosting activity in the housing market.

Savings Accounts: On the flip side, interest earned on savings may decrease, affecting returns for savers.

Implications for Buyers and Sellers

For Buyers: Lower rates mean reduced monthly mortgage payments, making homeownership more attainable. This could be a good time to explore the market if you’re considering purchasing a home.

For Sellers: Increased buyer activity might create more competition for properties, potentially supporting home prices. However, competitive pricing remains essential as market dynamics vary by location and economic factors.

A Look at Recent Rate Trends

The graph below illustrates the Bank of Canada's interest rate changes over the last three years. After peaking earlier in 2024, rates have steadily declined, with the latest cut reflecting efforts to support the slowing economy while keeping inflation near the 2% target.

What’s Next?

The Bank of Canada has emphasized a cautious approach moving forward, signaling that future decisions will be made “one meeting at a time.” Some Economists predict rates may stabilize between 2.5% and 3%, a range considered neutral for balancing economic growth and inflation control.

However, challenges remain. Potential U.S. tariffs could affect Canadian exports, adding uncertainty to the economic outlook.

Takeaways

The recent rate cuts aim to balance a cooling economy and steady inflation, offering opportunities like cheaper borrowing costs and potentially more active housing markets. Still, broader economic conditions warrant careful consideration for major financial decisions.

Stay informed as the Bank of Canada continues to adjust its policies. Understanding these changes can help you navigate their impacts on your finances and the real estate market.

Want more updates?

Subscribe to our newsletter for insights and tips to make informed decisions in today’s dynamic market.