Author: Real Insights Group Team | Date: December 08 2025

The Greater Toronto Area (GTA) housing market continued to recalibrate in November 2025 as home sales, new listings, and average selling prices declined compared to the same period last year. The trend reflects a market where many would-be buyers are waiting for stronger economic signals before re-entering the competition.

But beneath the softer year-over-year numbers lies an important story: employment strength, improving economic indicators, and stable month-to-month pricing suggest the foundation for recovery in 2026 is quietly forming.

📉 Sales and Listings Decline as Buyers Wait for Economic Clarity

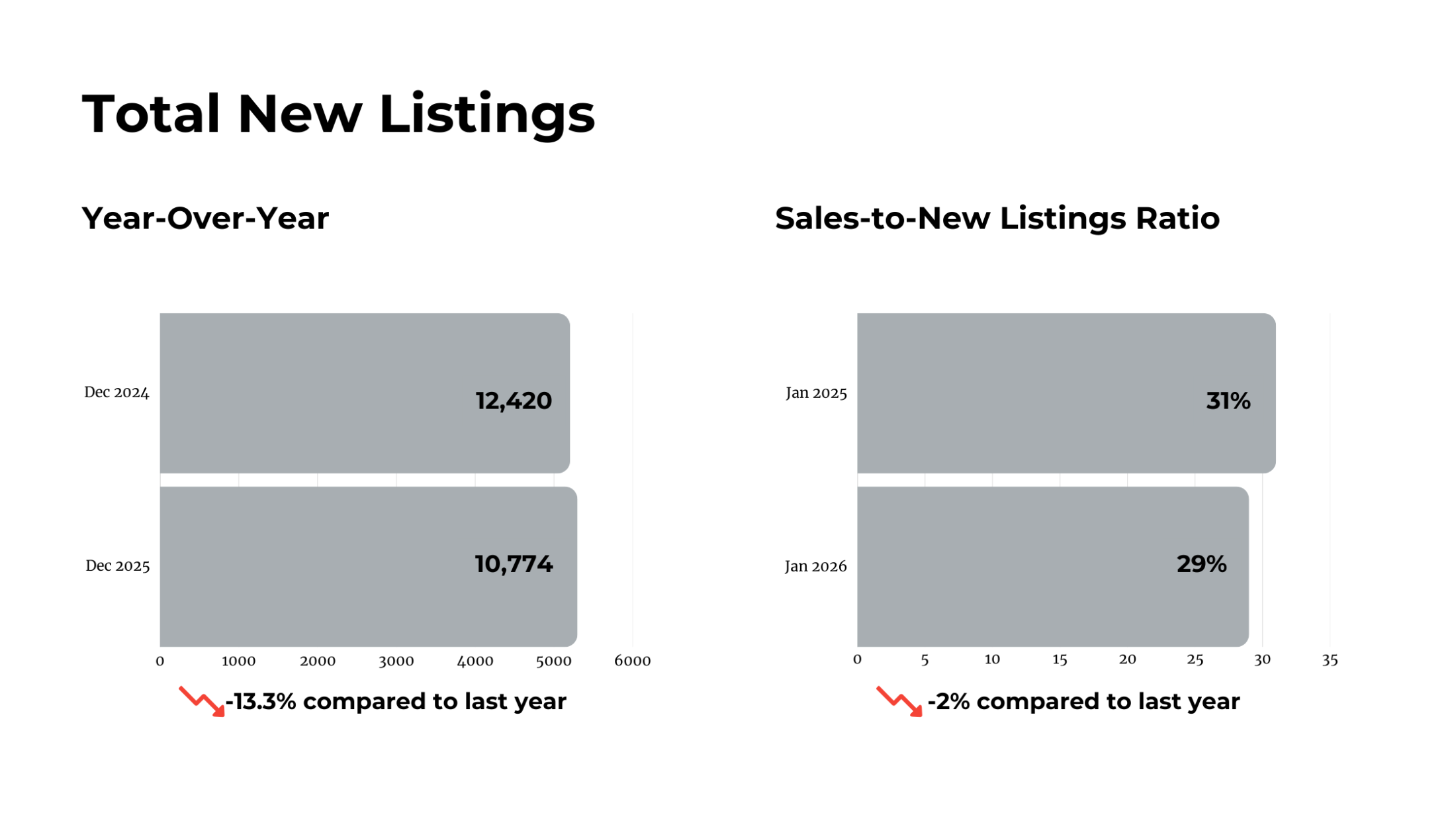

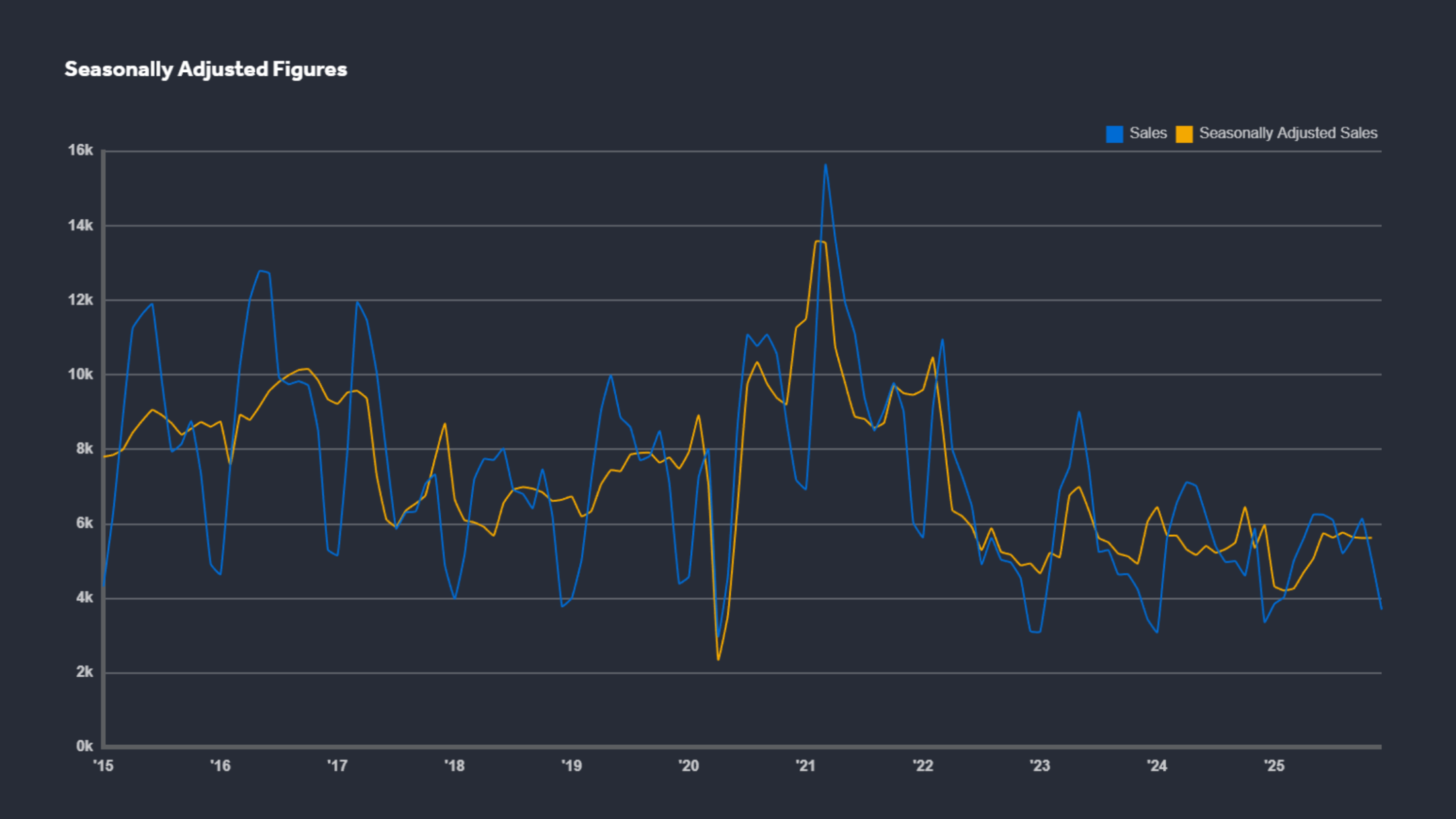

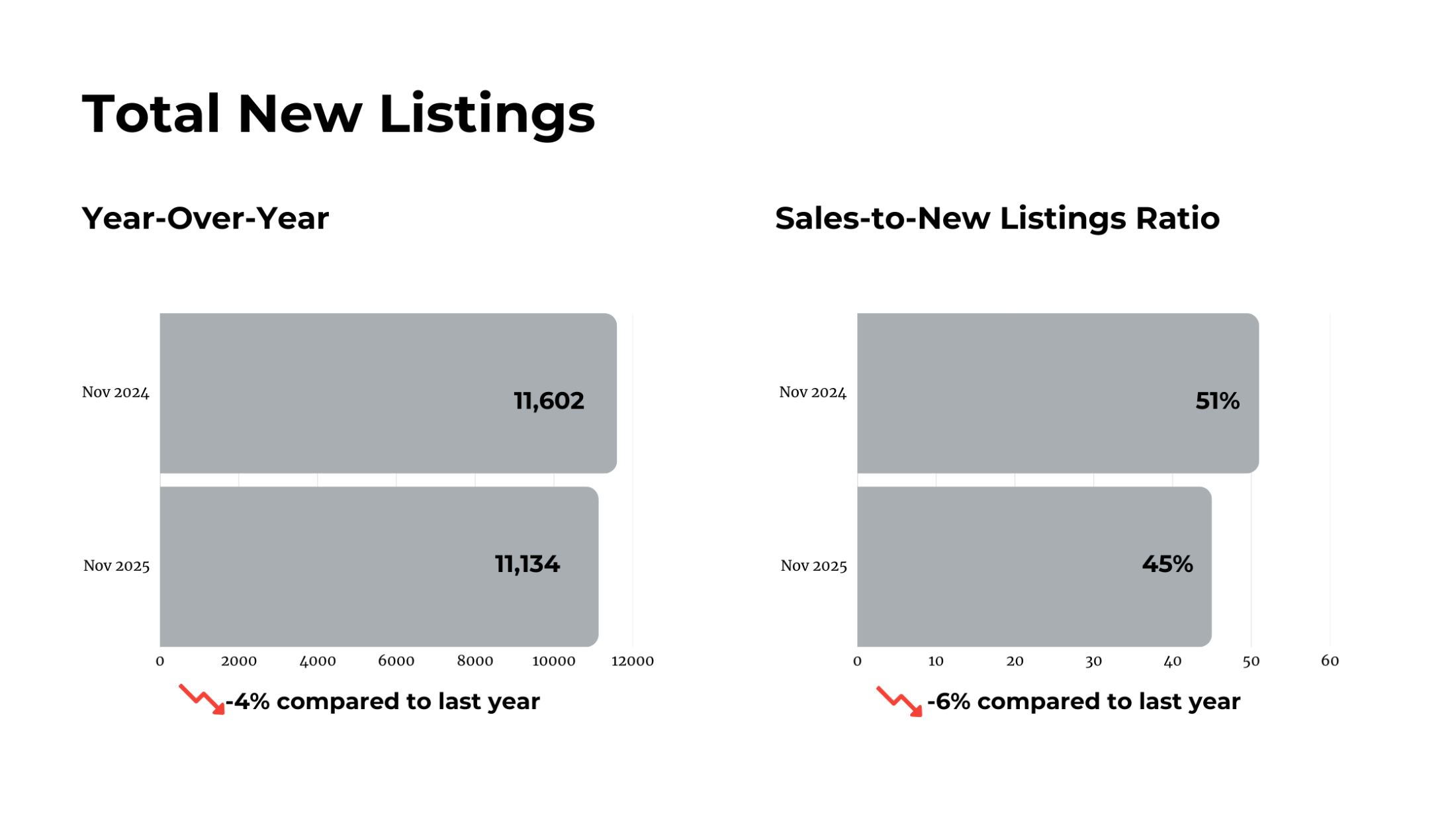

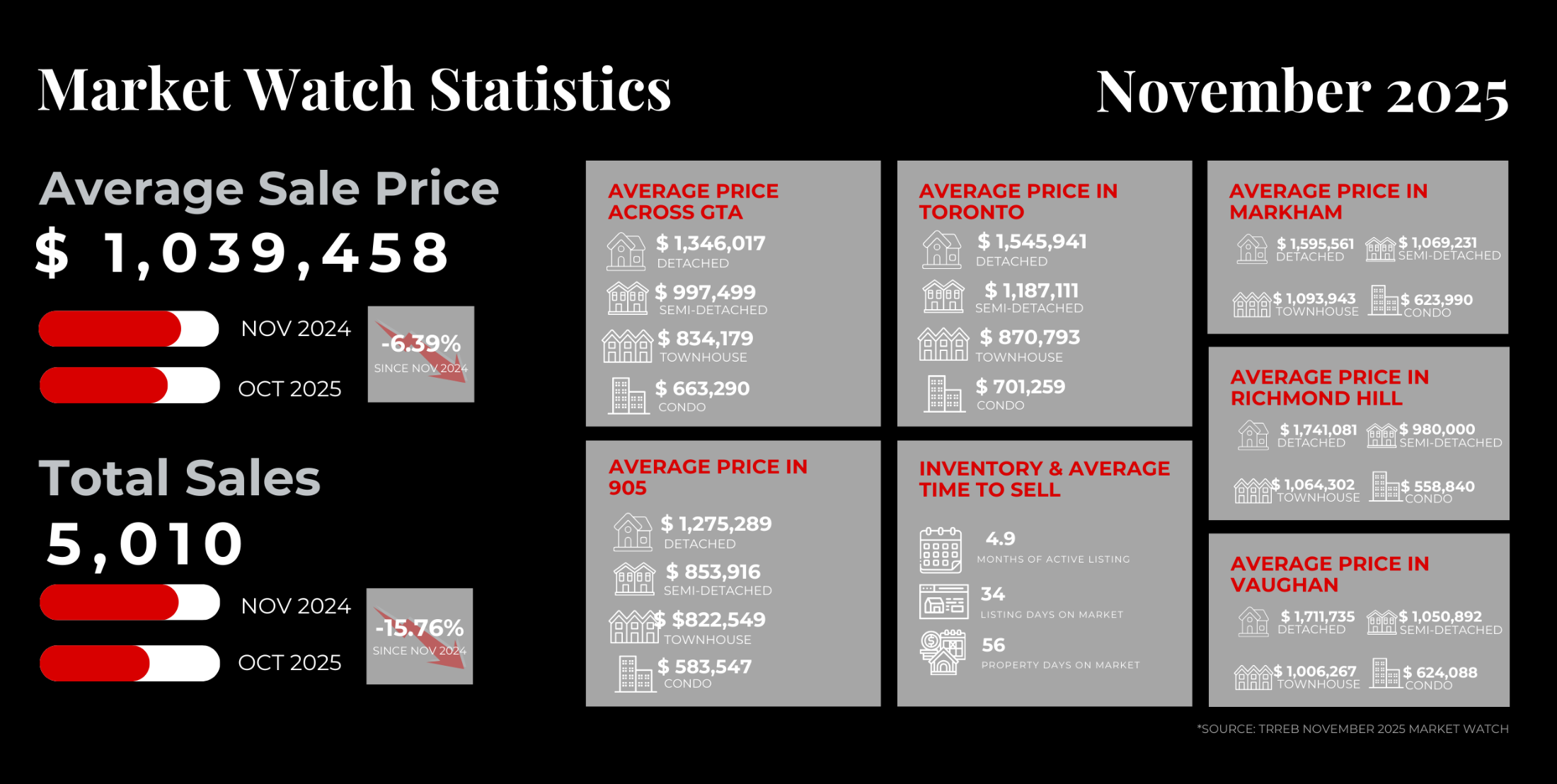

According to TRREB, REALTORS® reported 5,010 home sales across the GTA in November 2025 — a 15.8% decrease from November 2024. New listings totaled 11,134, down 4% year-over-year.

This cooling is less about lack of interest and more about buyer psychology.

“There are many GTA households who want to take advantage of lower borrowing costs and more favourable selling prices. What they need most is confidence in their long-term employment outlook,”

— TRREB President Elechia Barry-Sproule

Her comment captures the sentiment driving today’s market: demand exists, but confidence needs to catch up.

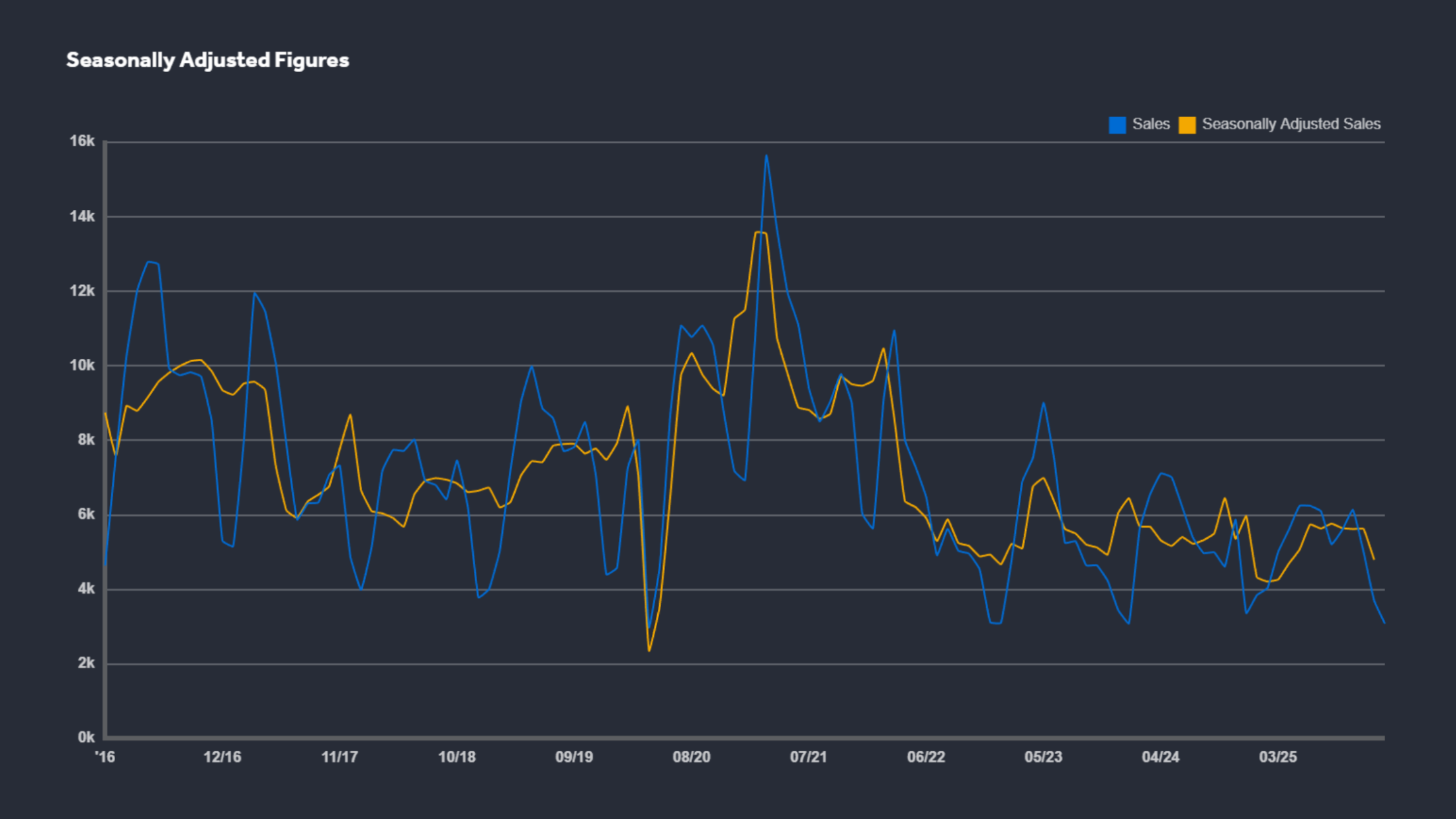

📊 Month-to-Month Numbers Show Early Signs of Stabilization

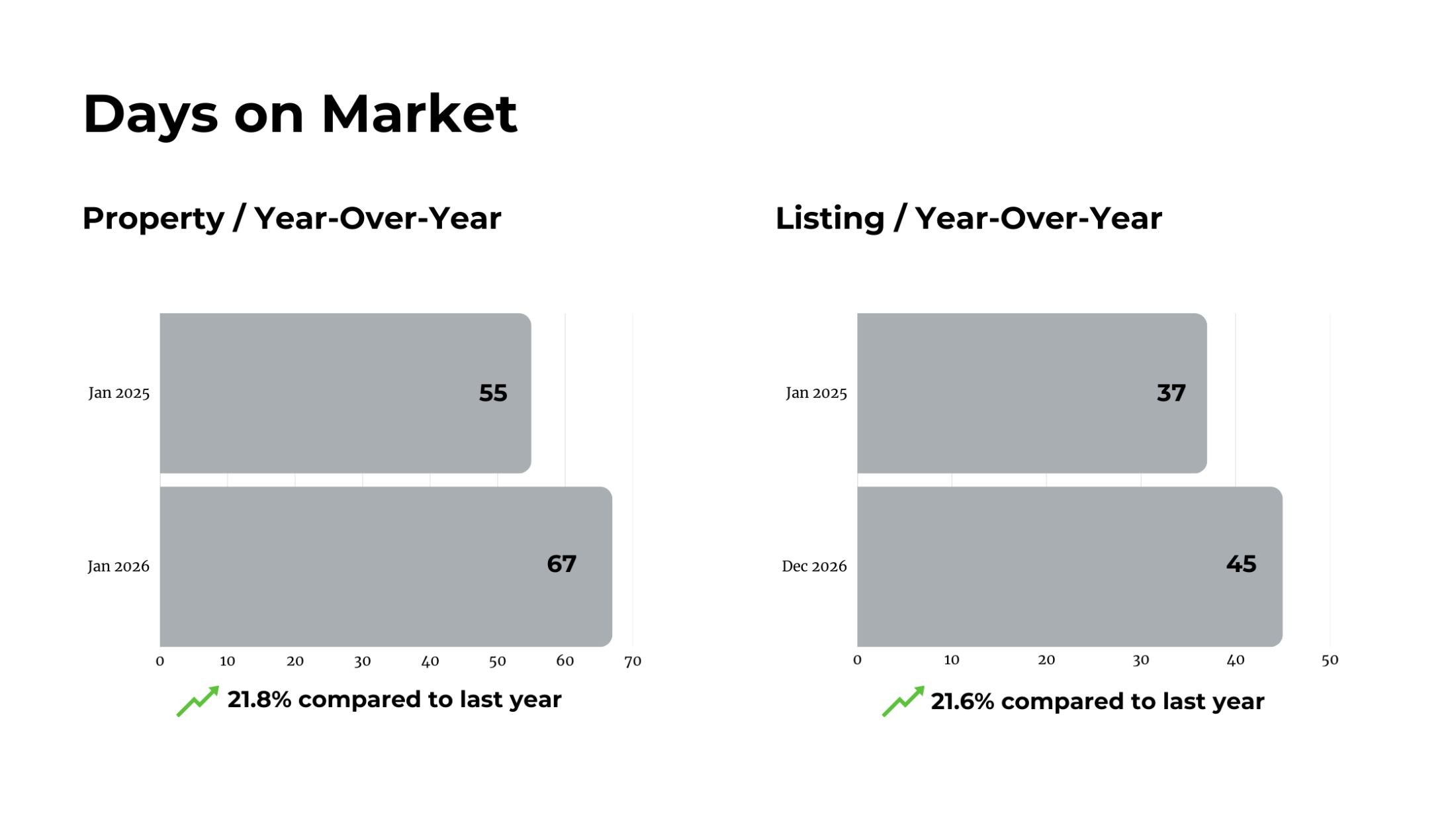

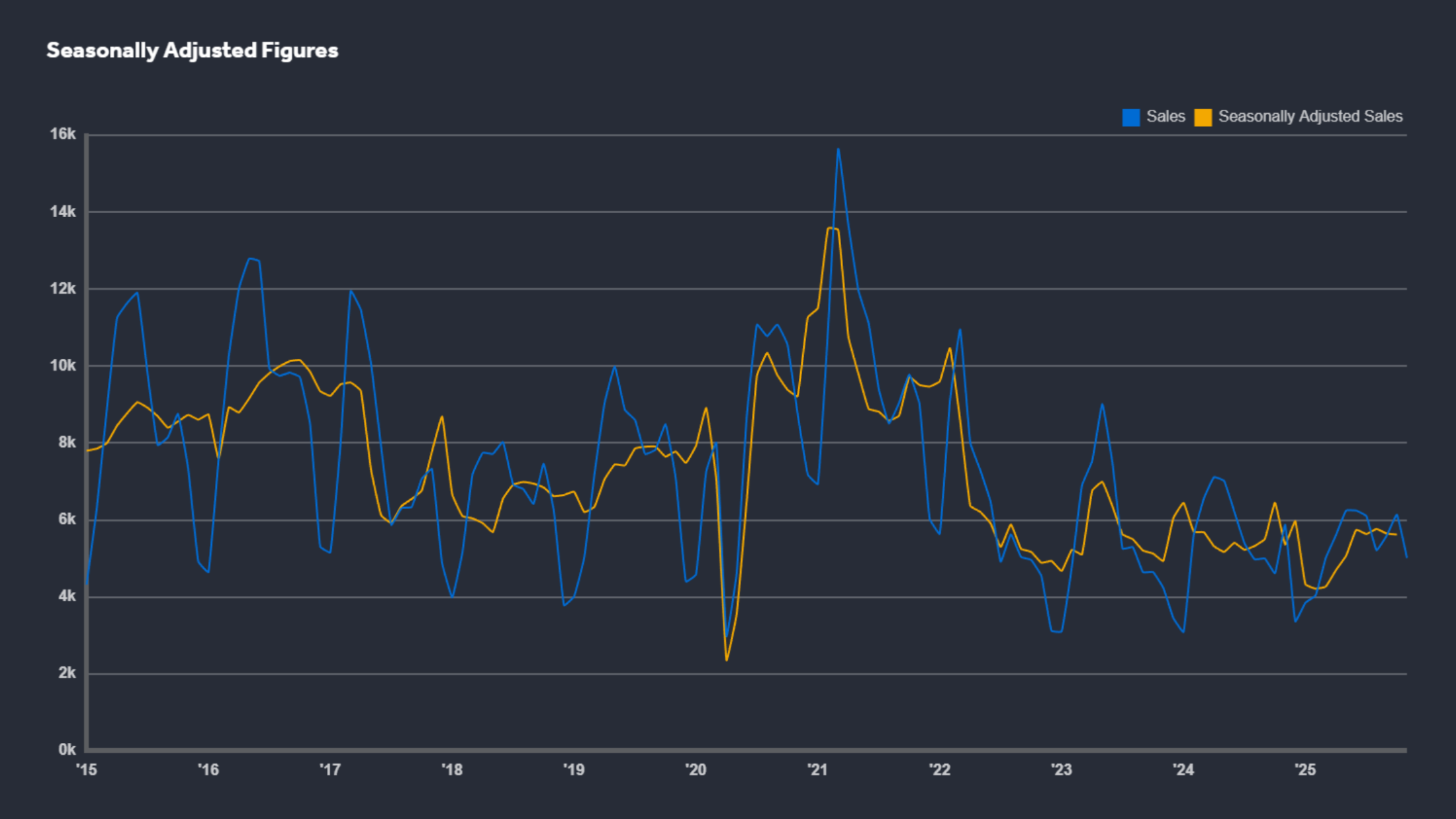

While year-over-year figures are softer, seasonally adjusted data paints a more balanced picture:

Sales dipped only slightly from October to November

New listings edged lower, keeping inventory healthy but not excessive

MLS® HPI Composite was marginally down from October

Average price inched upward month-over-month

In other words: we’re not seeing a downward slide — we’re seeing a market finding its footing.

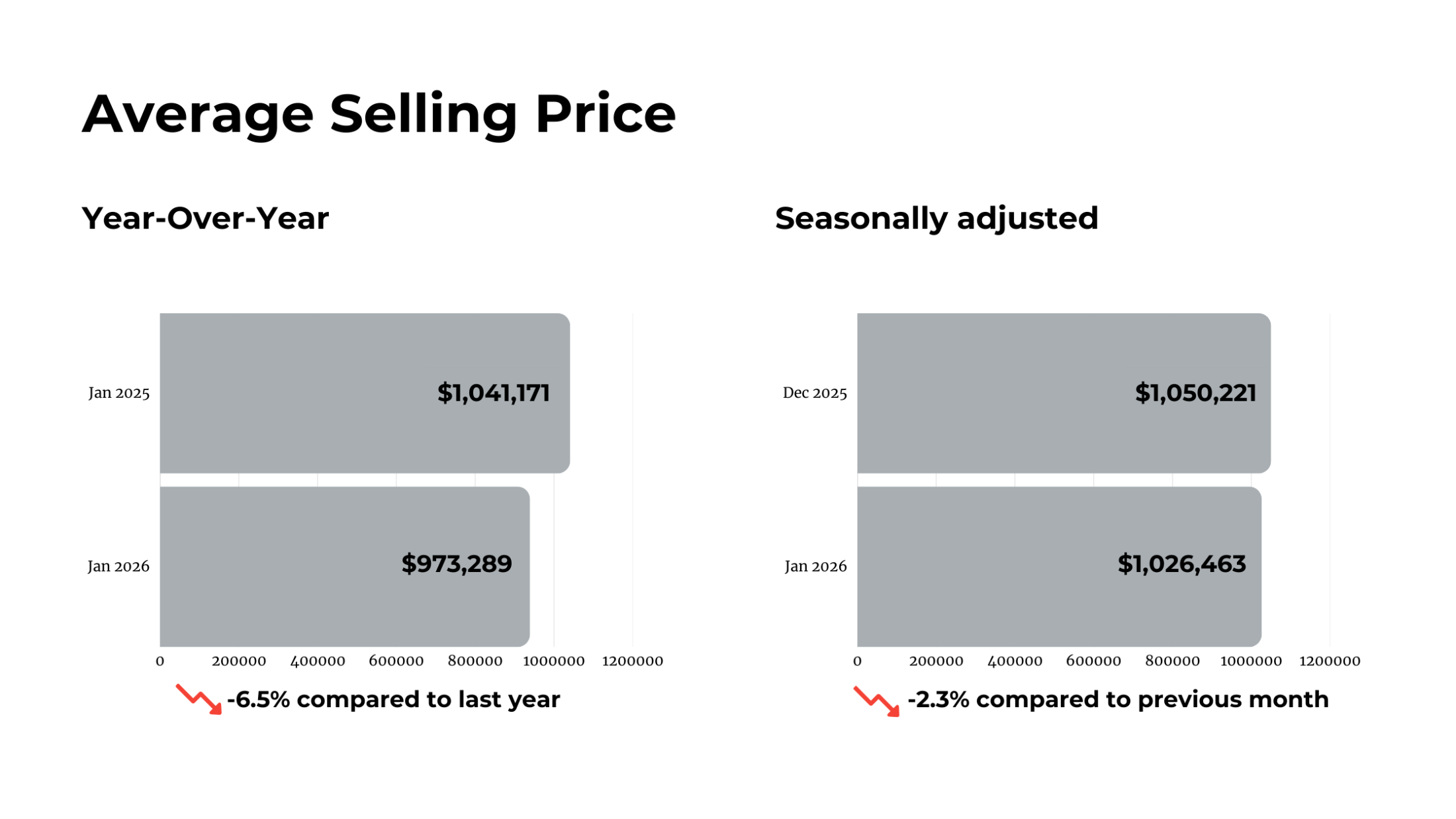

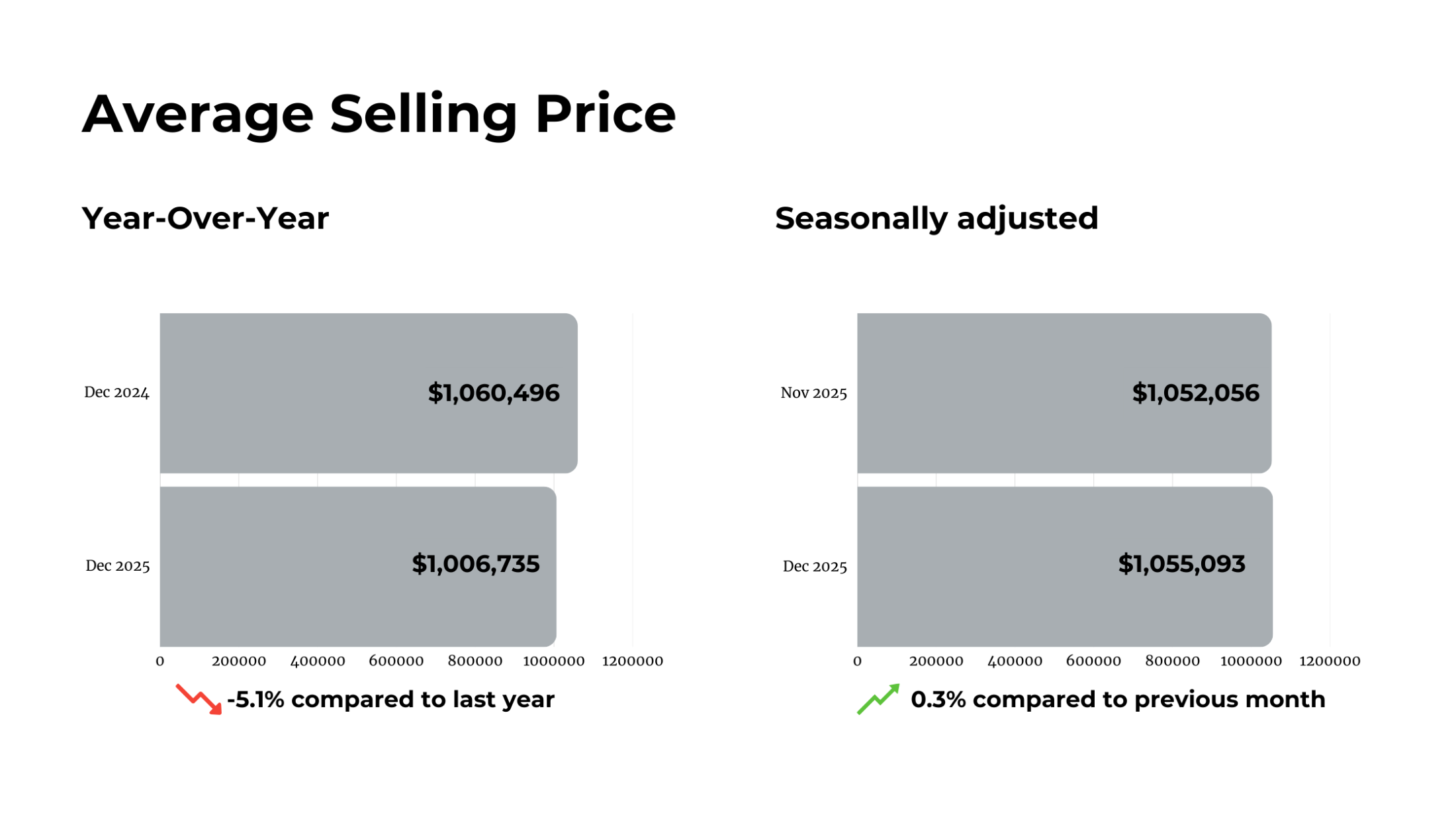

🏘️ Prices Down Annually — But Holding Steady Month-to-Month

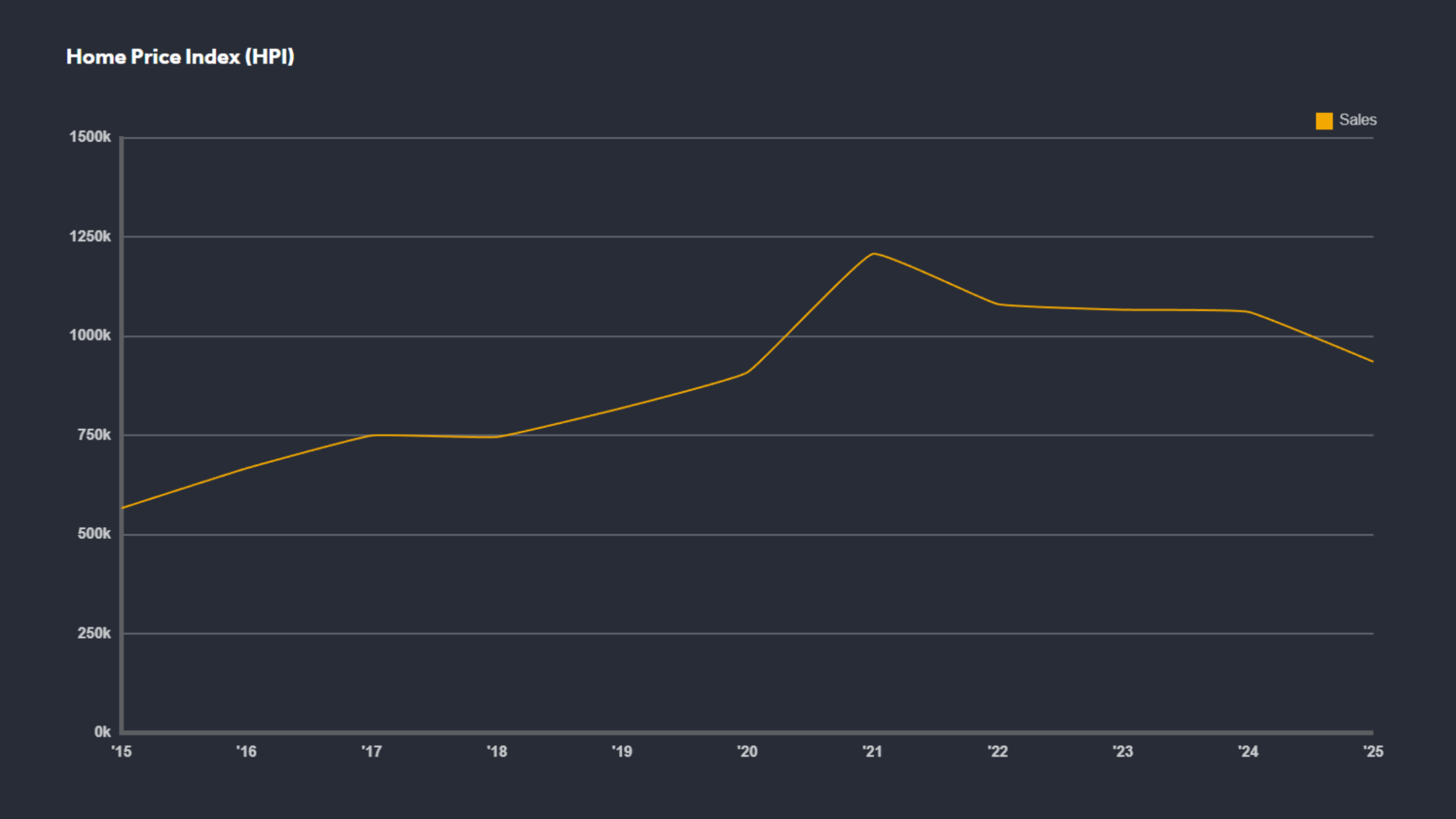

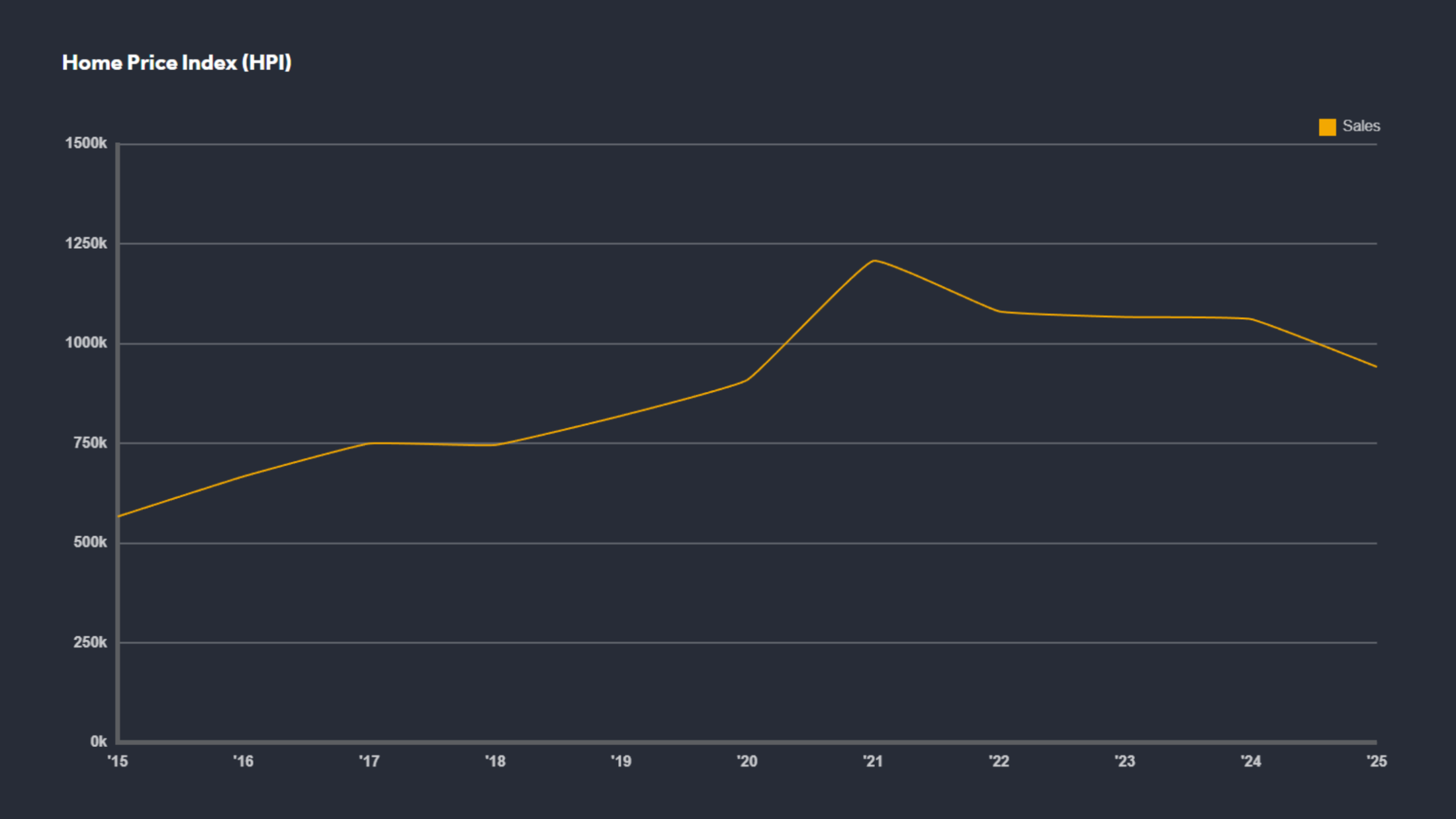

The MLS® Home Price Index (HPI) Composite Benchmark fell 5.8% year-over-year, reflecting the impact of cautious buyers and broader economic uncertainty.

The average selling price reached $1,039,458, down 6.4% from November 2024.

However, on a monthly basis, prices remained stable, signalling that sellers are adjusting realistically while buyers remain selective.

📈 Why 2026 Could See a Rebound: Economic Data Turns Positive

November delivered something the housing market desperately needed: good economic news.

Employment numbers beat expectations

Economic growth outperformed forecasts

Canada showed resilience against trade-related challenges

Infrastructure plans announced in late 2025 are poised to stimulate jobs and long-term housing demand

“More certainty on the trade front coupled with positive economic impacts of recently announced infrastructure projects could improve homebuyer confidence moving forward,”

— Jason Mercer, TRREB Chief Market Analyst

If this momentum holds, it could create the backdrop for a more confident buyer pool in 2026, particularly in the spring and early fall cycles.

🏗️ A Well-Supplied Market — But Not Indefinitely

Despite moderating demand, the GTA continues to benefit from healthy resale inventory, giving buyers more choice than in previous tight markets.

However, TRREB issues a caution:

“As this inventory is absorbed, new construction is required to fill the housing pipeline,”

— John DiMichele, TRREB CEO

The call is clear:

To stabilize prices long-term and support population growth, Ontario needs more housing — not only condos, not only detached homes, but the missing middle in between.

Expect government incentives and development activity to be major conversations heading into 2026 and beyond.

🔑 The Bottom Line for Buyers and Sellers

For Buyers:

You are currently in one of the most favourable purchasing environments in recent years:

As employment data improves, you may not see this level of choice for long.

For Sellers:

While year-over-year prices are lower, stable monthly pricing suggests the market is nearing a baseline. Sellers who price strategically are still securing strong results — particularly in segments with limited supply (detached homes in prime school zones, family-oriented neighbourhoods, and transit-connected communities).

Looking Ahead to 2026

The GTA housing market is transitioning, not declining. Economic strength, job growth, and infrastructure investment will be the biggest catalysts heading into the new year.

If confidence continues to build, 2026 may mark the beginning of a more active and competitive market cycle.

Thinking About Buying or Selling in 2026?

We provides data-backed, neighbourhood-specific advice for buyers, sellers, and investors across the GTA.

If you’d like a custom breakdown of market trends in your area, contact us if want to know where the real opportunities are emerging.