The latest October 2025 stats from the Toronto Regional Real Estate Board (TRREB) paint a clear picture: the Greater Toronto Area (GTA) housing market continues to lean in favor of buyers. With home sales dipping and new listings climbing, those who are ready to make a move could find opportunities that simply weren’t available a year ago.

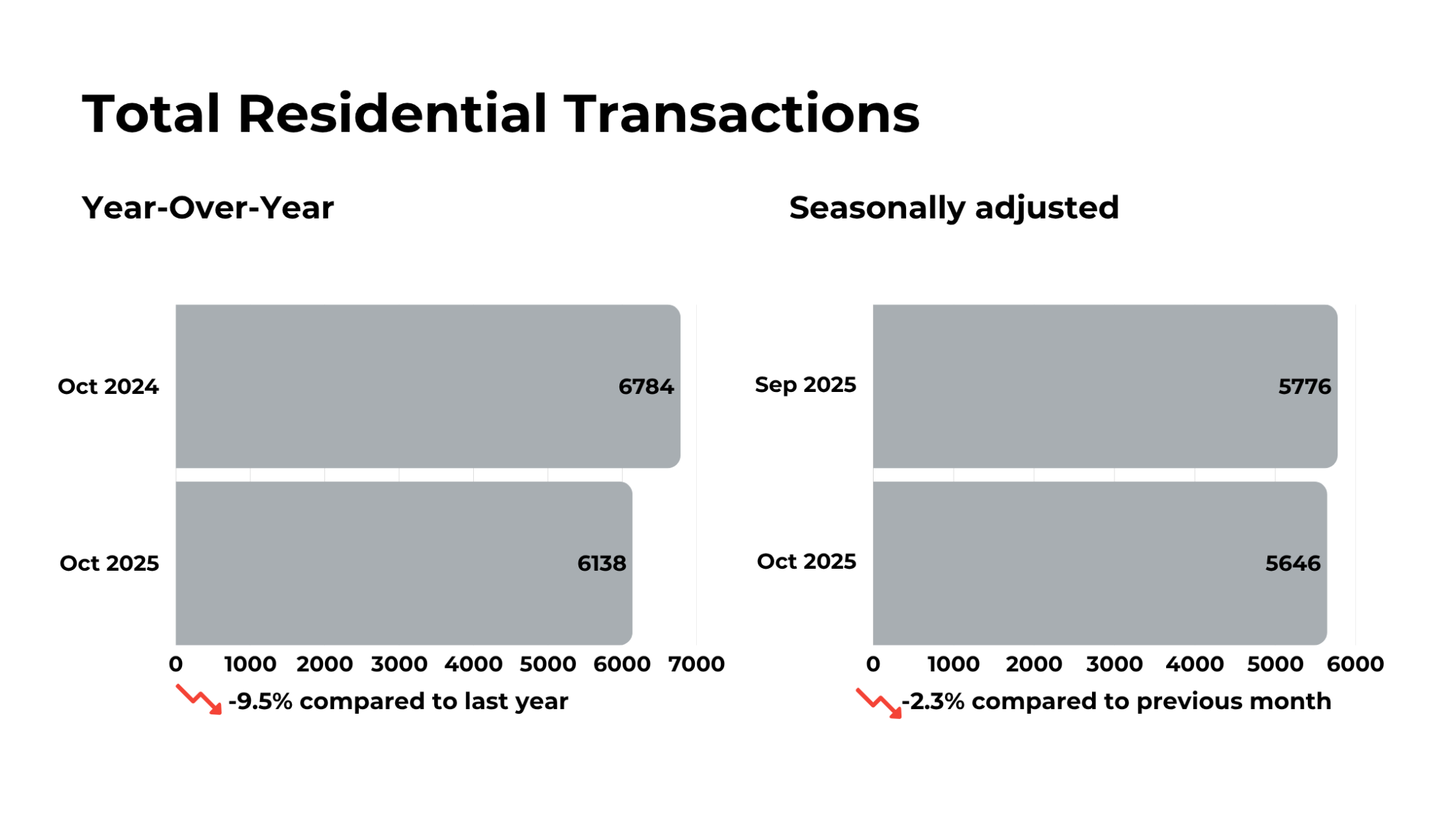

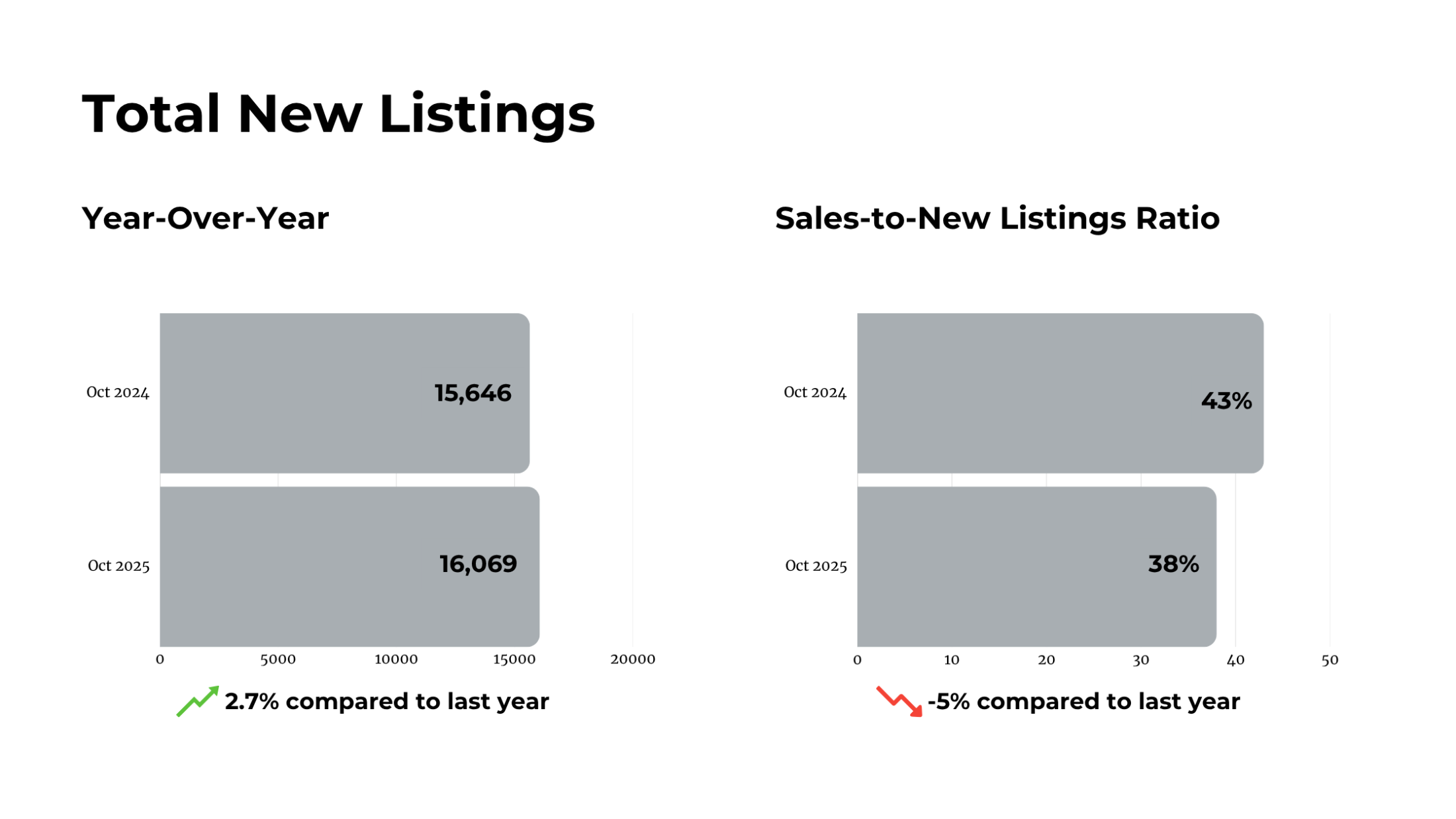

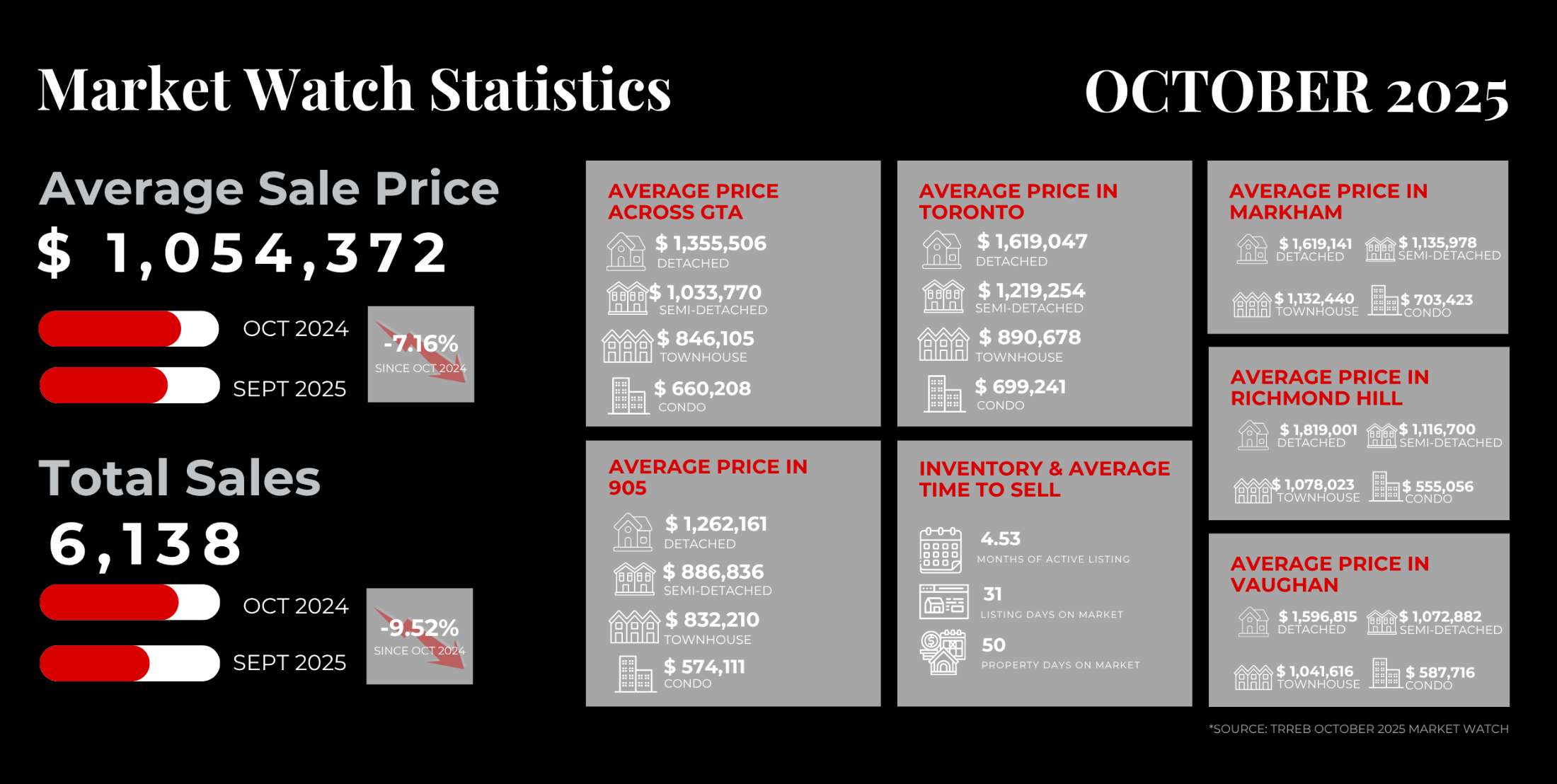

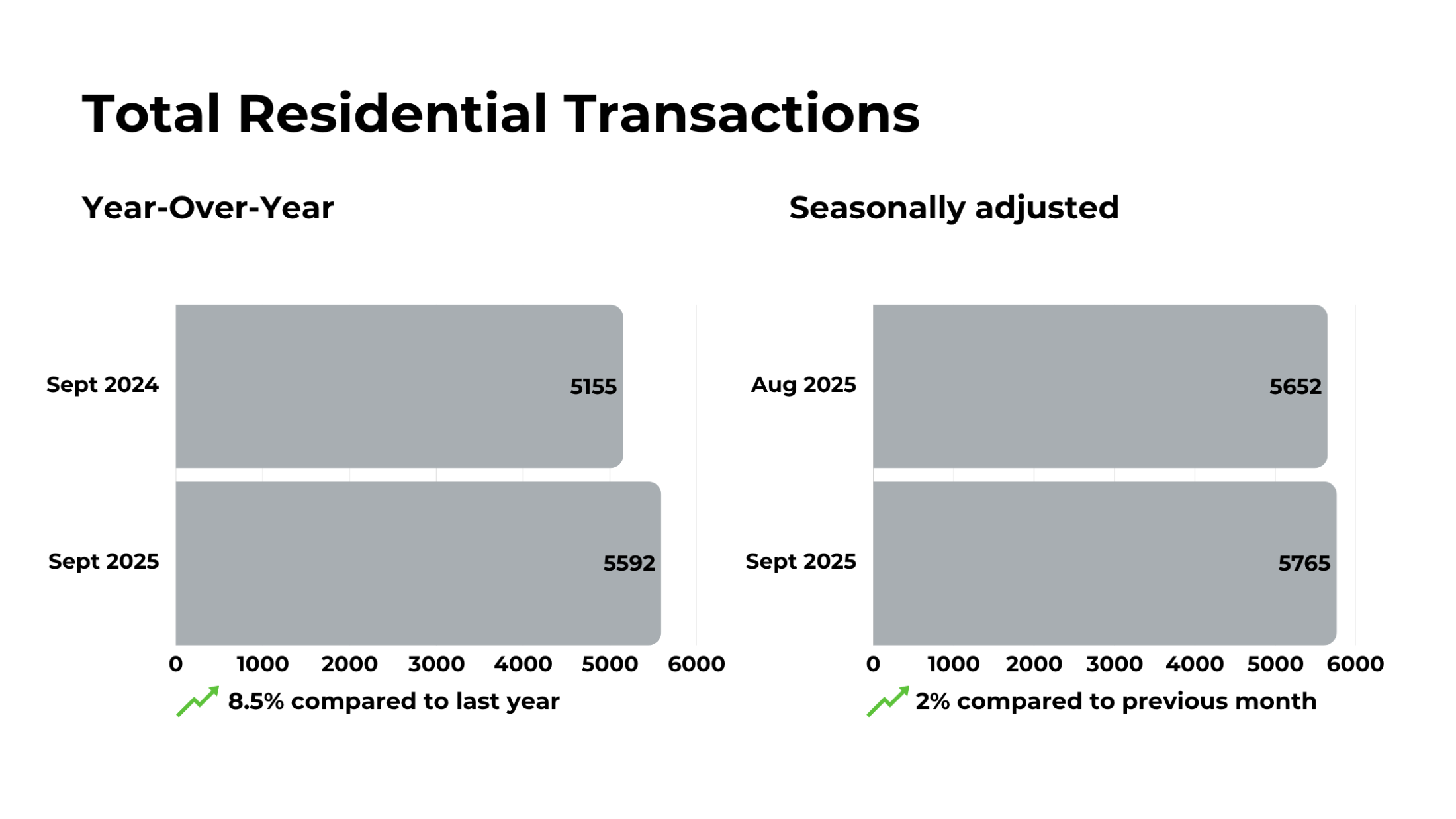

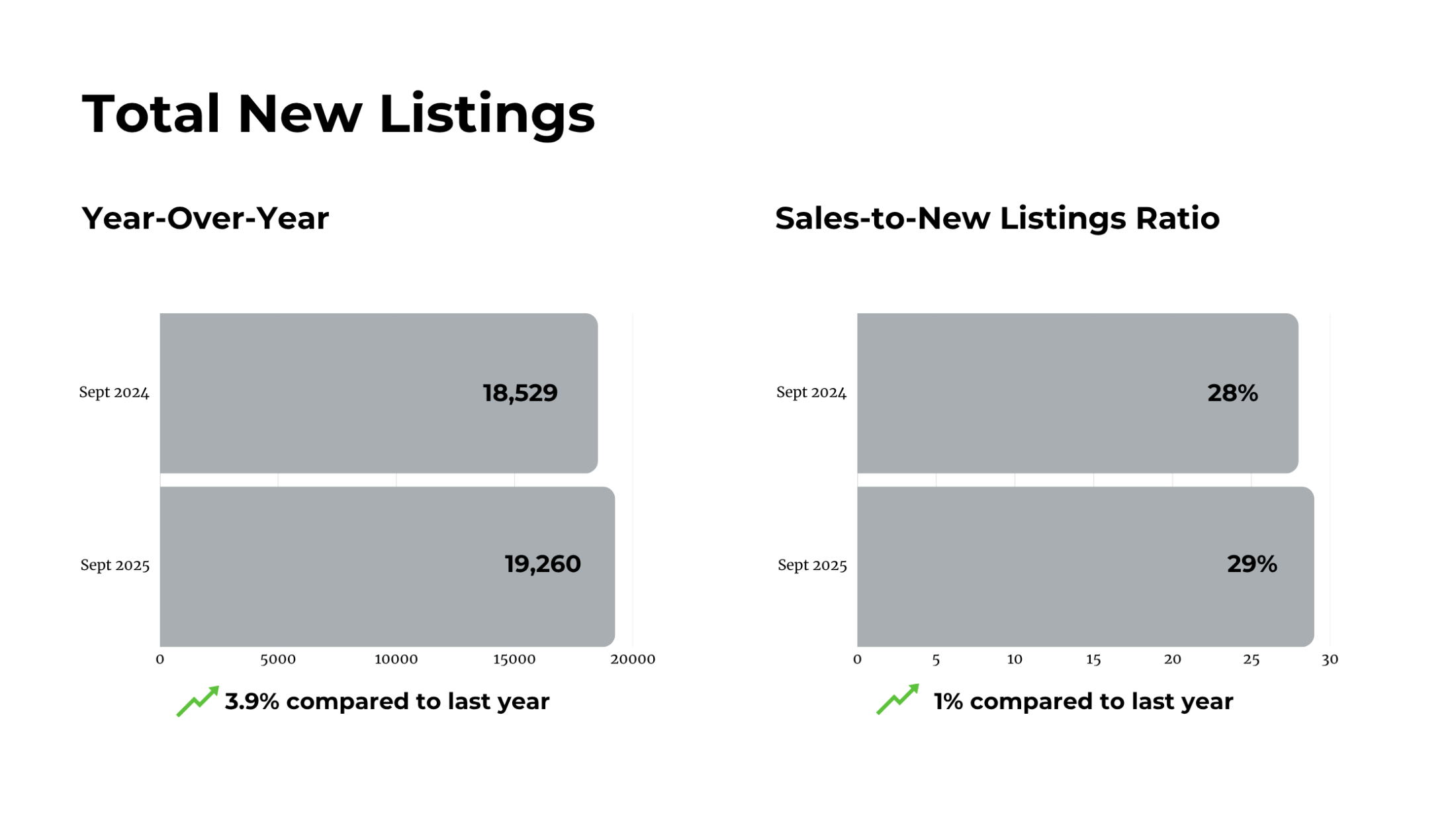

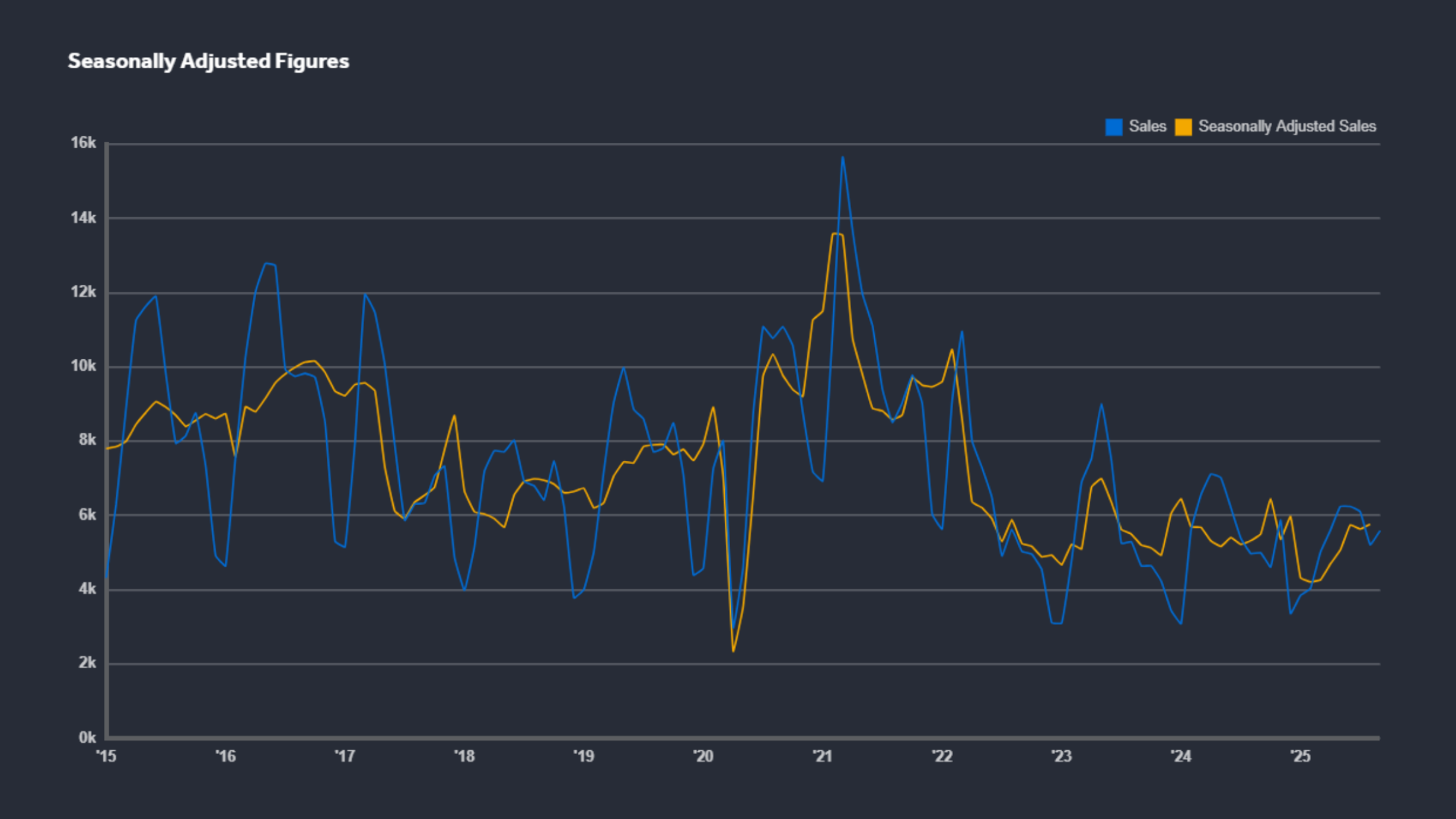

According to TRREB, GTA REALTORS® reported 6,138 home sales through the MLS® System in October — down 9.5% from October 2024. On the other hand, new listings rose by 2.7%, reaching 16,069 homes.

This shift means more options for buyers to choose from, and sellers are feeling the pressure to price more competitively.

💰 Prices and Mortgage Trends

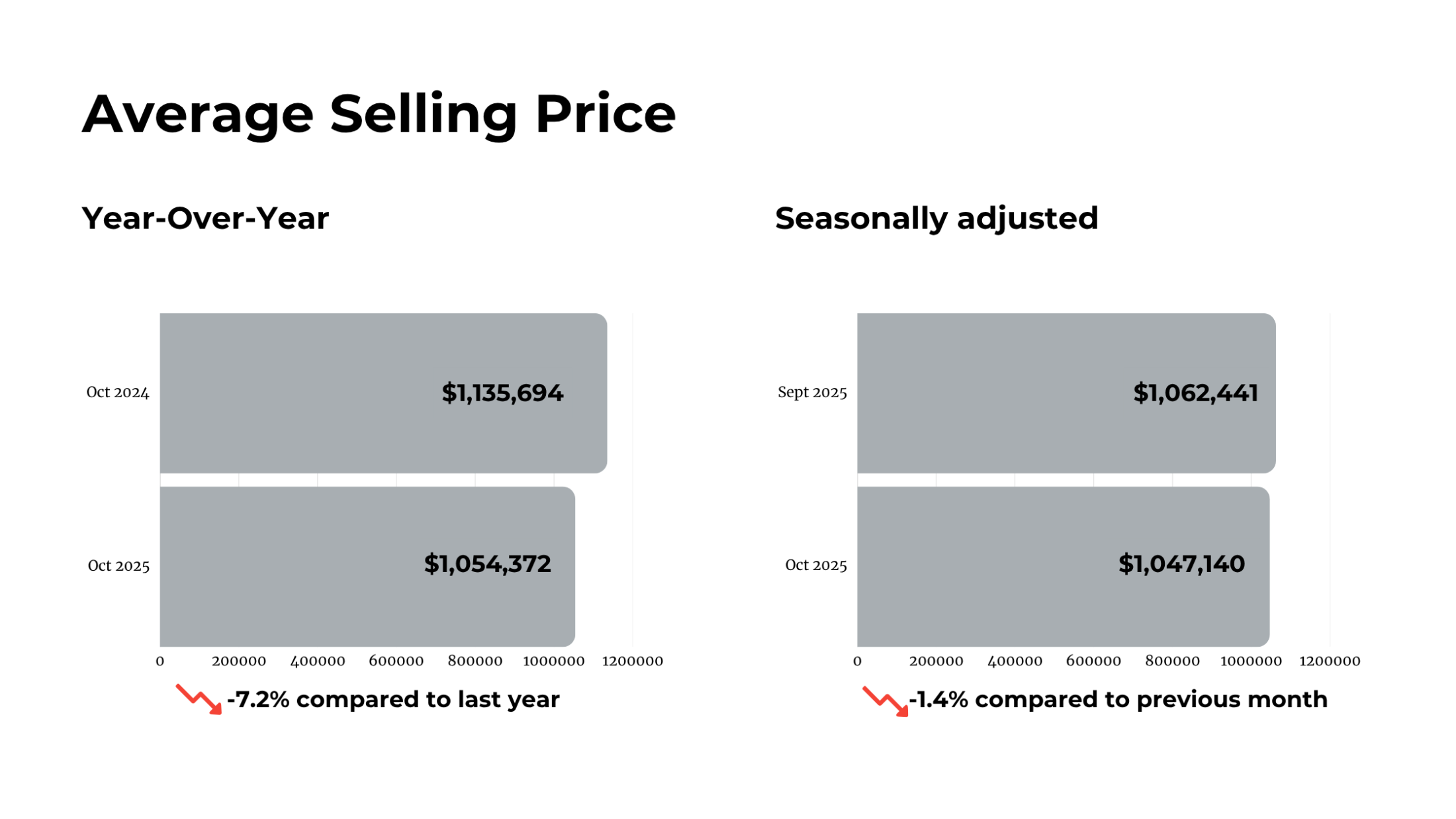

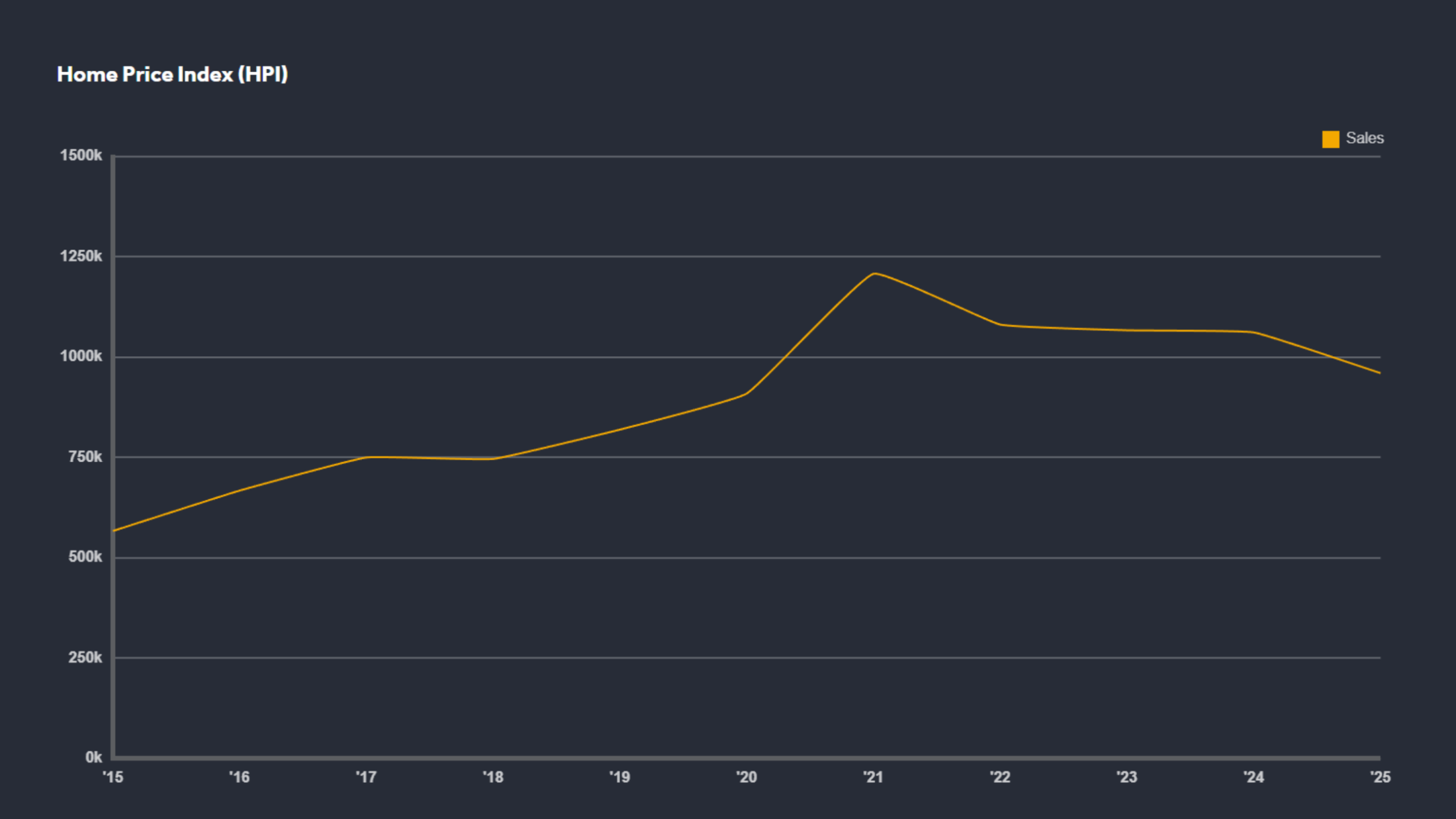

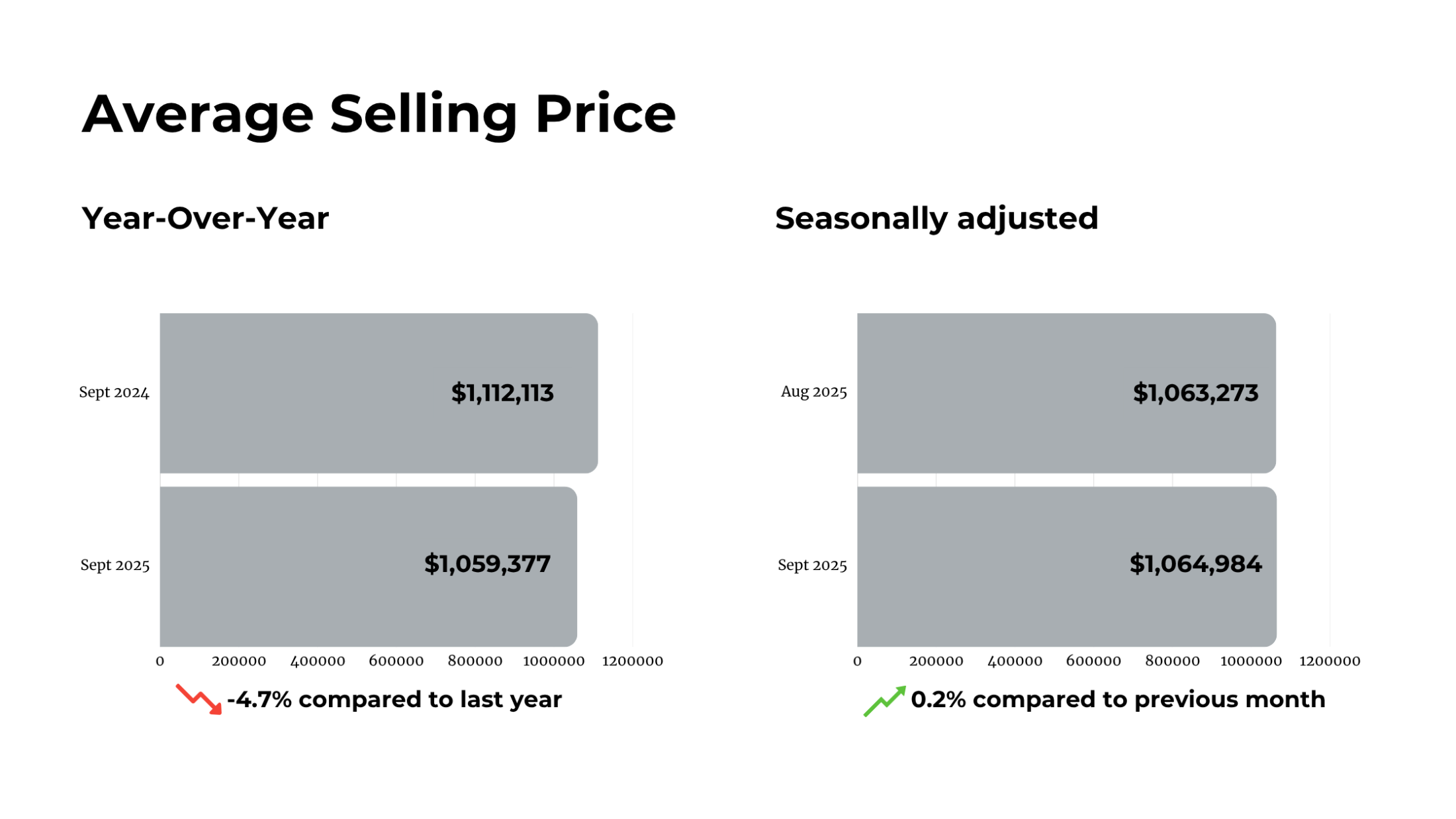

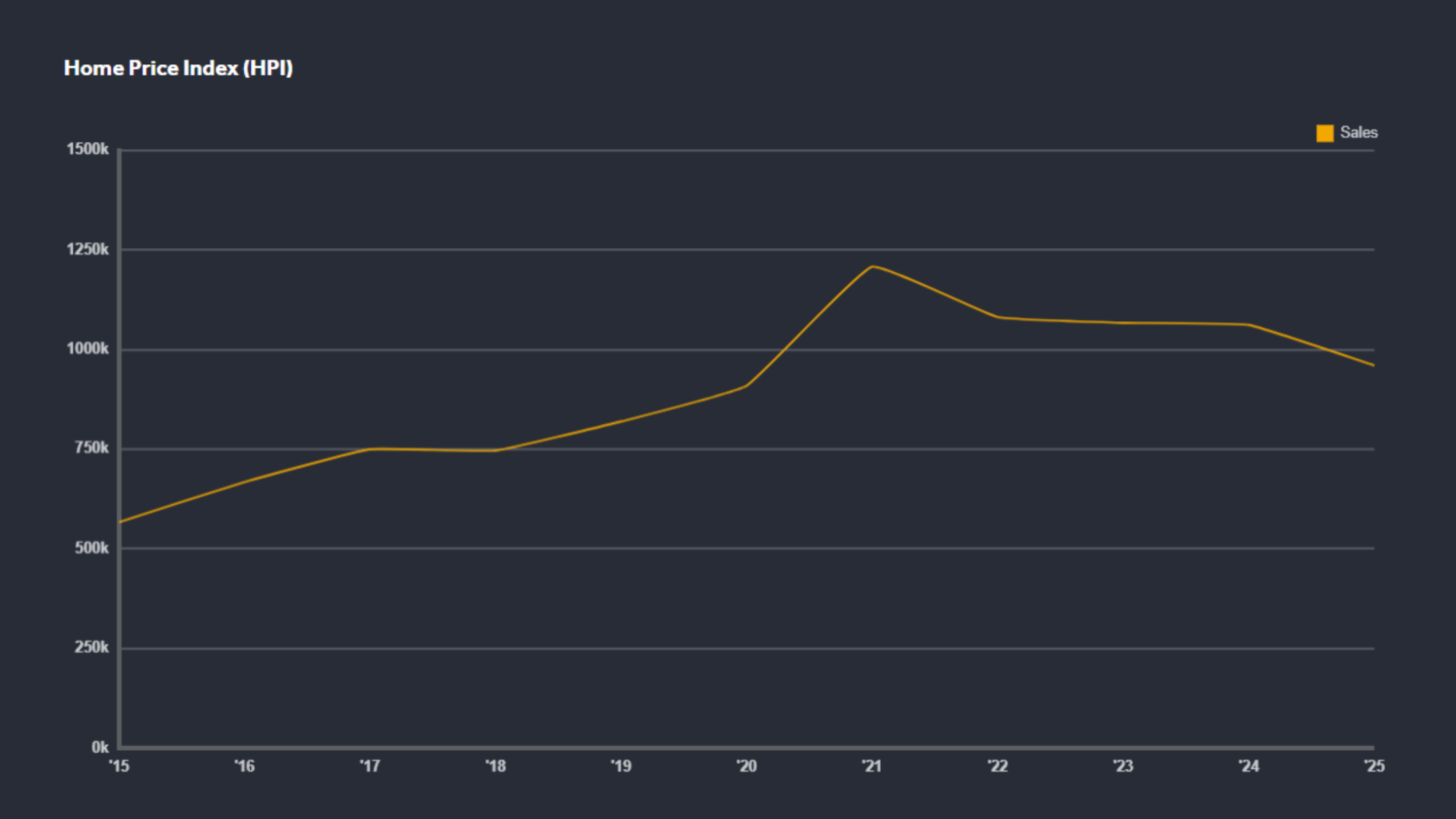

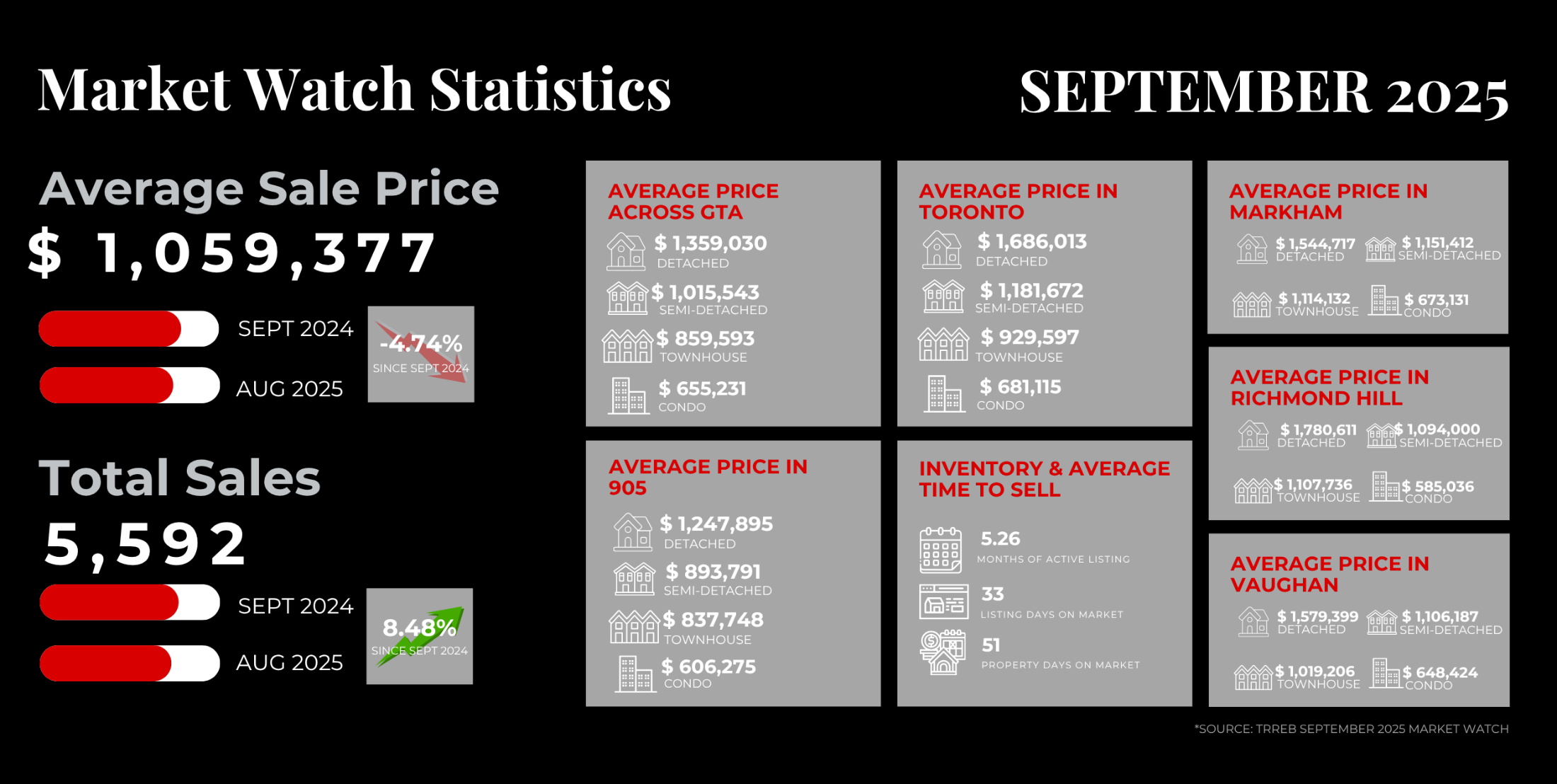

The average selling price in October 2025 was $1,054,372, marking a 7.2% decrease year-over-year. The MLS® Home Price Index (HPI) also dropped 5% compared to last year.

But here’s the silver lining: mortgage rates have eased, and with prices down, monthly payments are becoming more manageable for many buyers.

As TRREB Chief Information Officer Jason Mercer explained, “The monthly mortgage payment for an average-priced GTA home continued to trend lower in October, benefitting from both lower borrowing costs and lower selling prices.”

This combination is giving confident buyers, especially those secure in their employment — a rare opportunity to enter the market under more affordable conditions than we’ve seen in recent years.

While lower prices are good news for buyers, many are still hesitant due to economic uncertainty. TRREB President Elechia Barry-Sproule noted that although some buyers are taking advantage of the current affordability, others remain on the sidelines, waiting for clearer signals about the economy.

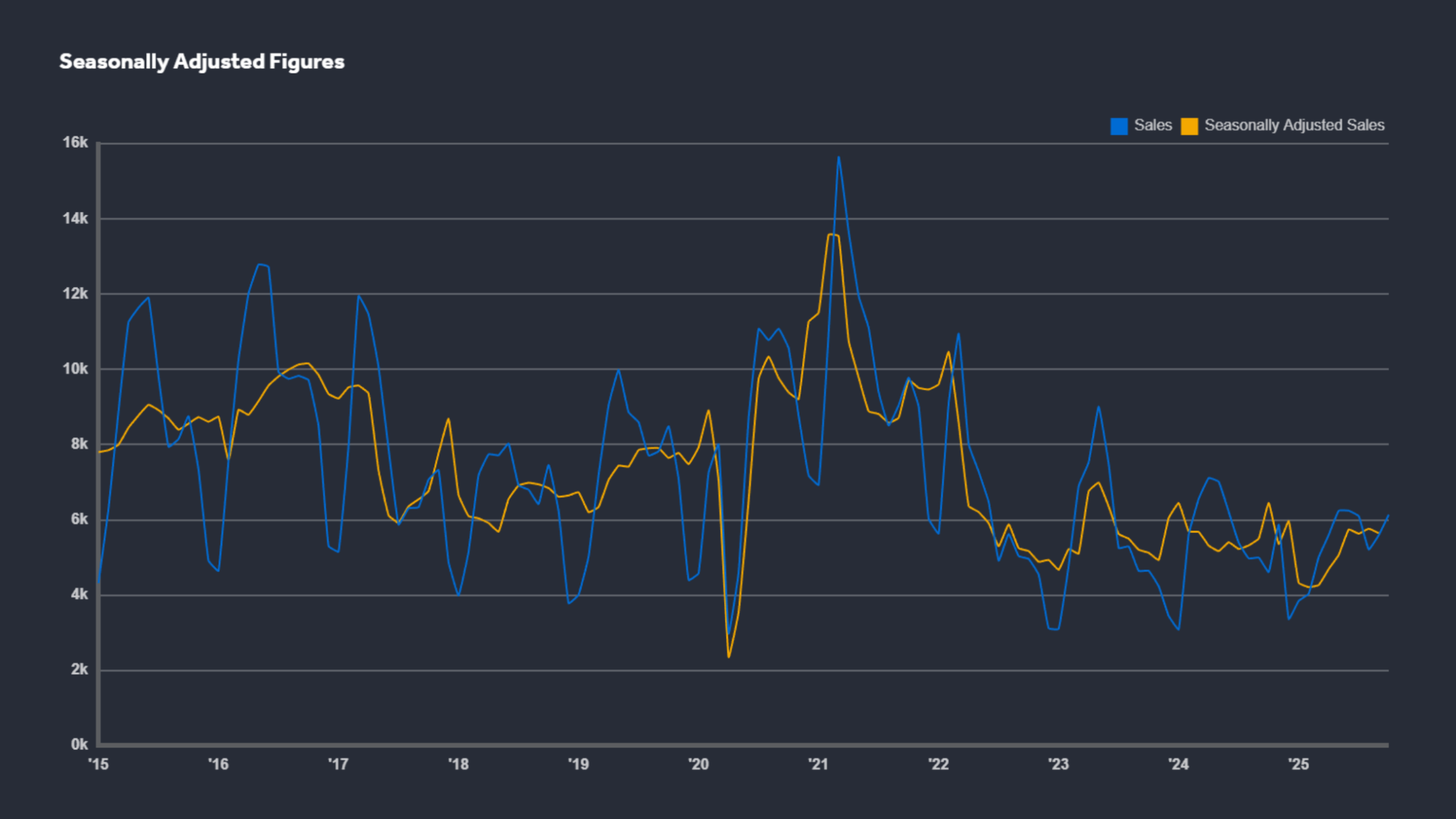

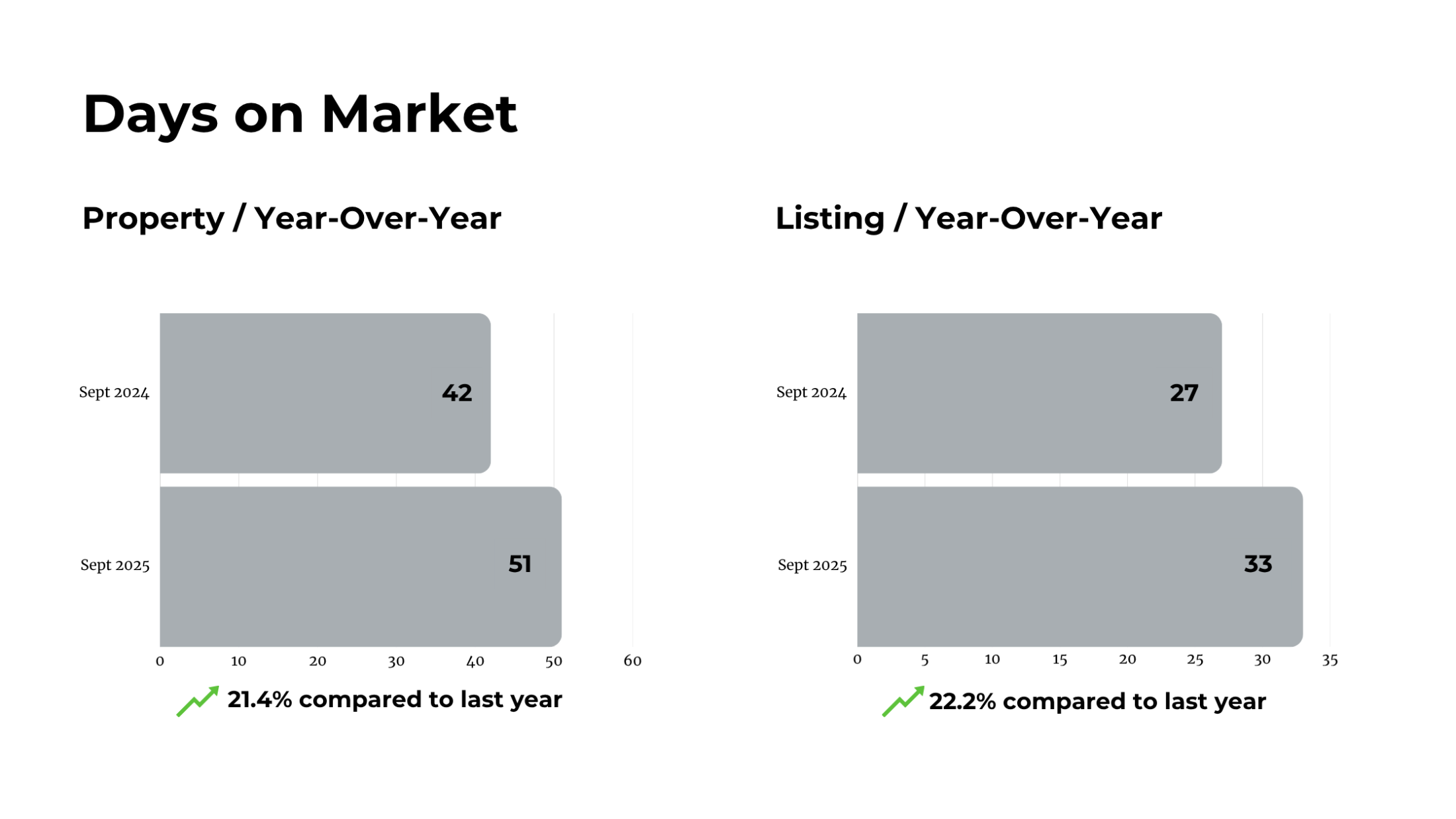

Month-over-month data also shows that sales and new listings both dipped slightly from September, suggesting the fall market cooled off earlier than usual.

📌 What the Recent Bank of Canada Rate Cut Means

On October 29, 2025, the Bank of Canada lowered its target for the overnight rate by 25 basis points to 2.25%.

This move is significant for the real estate market for several reasons:

Lower overnight rates typically influence borrowing costs, including mortgage interest rates, which can make homes more affordable for buyers.

With the central bank signalling that this cut might be one of the last in this cycle unless inflation or growth deviate significantly, the room for further rate relief may be limited.

For those considering buying or investing, this rate cut strengthens the argument for acting now before rates potentially rise or remain flat for longer.

In short: lower central-bank rates + lower home prices = enhanced opportunity for qualified buyers. For sellers, it means being realistic about pricing and preparing for competition.

Looking ahead, TRREB CEO John DiMichele emphasized the importance of housing as “essential economic infrastructure” and called for greater collaboration between the public and private sectors. With Ontario’s growing population, he pointed to the need for more innovation, faster construction, and updated government policies, including modernized tax rules and zoning reforms — to meet housing demand.

From my perspective as a local real-estate professional, this is a strategic window for buyers who have been waiting for prices and mortgage rates to align.

While market confidence is still rebuilding, today’s buyers have more negotiation power and less competition compared to the boom years.

If you’re thinking about buying or investing, this could be the right time to explore opportunities especially before market activity picks up again once economic conditions stabilize.

👉 Subscribe to my monthly newsletter for exclusive insights and local market updates