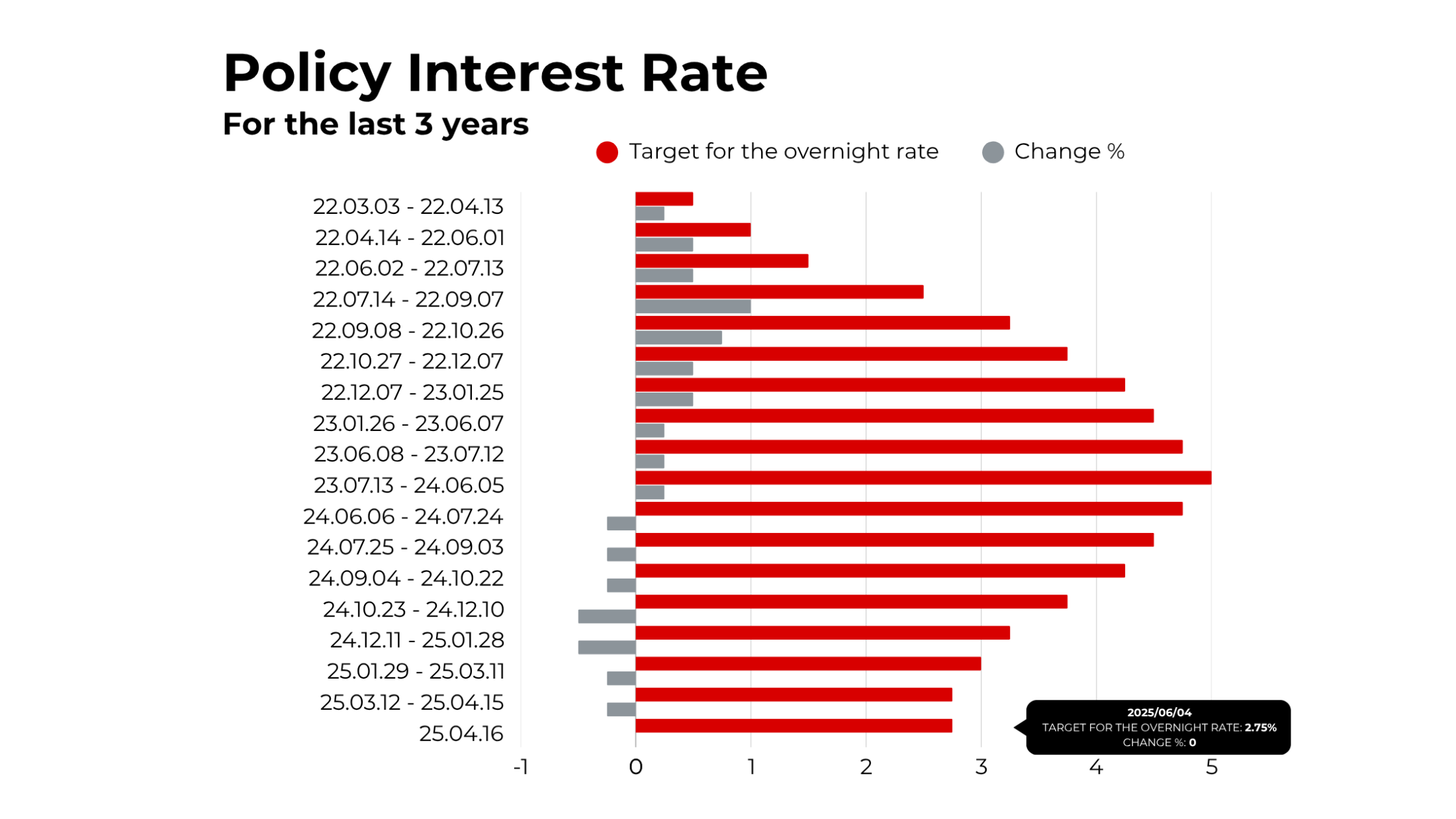

The Bank of Canada just announced that it’s keeping its key interest rate steady at 2.75%. That means borrowing costs, like loans and mortgages, aren’t going up (at least for now). The Bank Rate is set at 3%, and the deposit rate is 2.70%. So, why did the Bank decide to hold steady?

There’s still a lot of tension around global trade especially between the U.S. and China. While things have cooled a little and new talks are happening, the situation is still unpredictable. Tariff rates (those taxes on imports) are much higher than they were at the start of 2025, and more changes could be on the way.

Even though the world economy has been holding up, some of that strength came from businesses rushing to act before new tariffs kicked in. That’s not likely to last. In the U.S., people are still spending, but imports have slowed the economy a bit. Inflation in the U.S. is above 2%, and Europe is leaning on exports and defence spending. China’s growth is slowing down, too.

What’s Happening in Canada?

Canada’s economy grew by 2.2% in the first quarter—slightly better than expected. A big part of that growth came from increased exports to the U.S. and businesses stocking up on inventory. But consumer confidence has dropped, and people are spending a bit less. Housing activity is down, and unemployment has gone up to 6.9%, especially in industries that depend heavily on trade.

Looking ahead, the Bank expects the Canadian economy to slow down in the second quarter. Exports and inventory boosts are expected to fade, and household and business spending is likely to stay soft.

About the Inflation

Canada’s inflation rate dropped to 1.7% in April, mostly because the federal carbon tax was removed. But if you take taxes out of the picture, prices actually rose by 2.3%—a bit higher than the Bank expected.

People are still worried that tariffs will make things more expensive, and many businesses say they plan to pass those costs onto customers. So, even though the economy is softening, price pressures haven’t gone away.

Why the Bank Is Staying Put (For Now)

With all this uncertainty—especially around U.S. trade policy—the Bank of Canada is choosing to wait and see. Some parts of the economy are slowing, but inflation is still higher than they’d like in certain areas. The Bank wants to make sure inflation doesn’t get out of control, while also not putting more strain on a slowing economy.

They’re watching a few key things very closely:

Will U.S. tariffs reduce demand for Canadian products?

How will this affect investment, jobs, and household spending?

How quickly will rising costs show up in consumer prices?

Are inflation expectations rising?

What’s Next?

The Bank’s next interest rate decision and full economic report will be released on July 30, 2025. Until then, they’ll be keeping a close eye on the data and any changes in global trade policies.

The Bank of Canada is staying cautious. The economy is showing some cracks, but inflation is still a concern. So, they’re keeping rates steady while they wait for more clarity—especially from our neighbours in the U.S.

If you're a business owner or homeowner, now might be a good time to review your financial plans. While rates aren’t going up, the outlook remains uncertain.