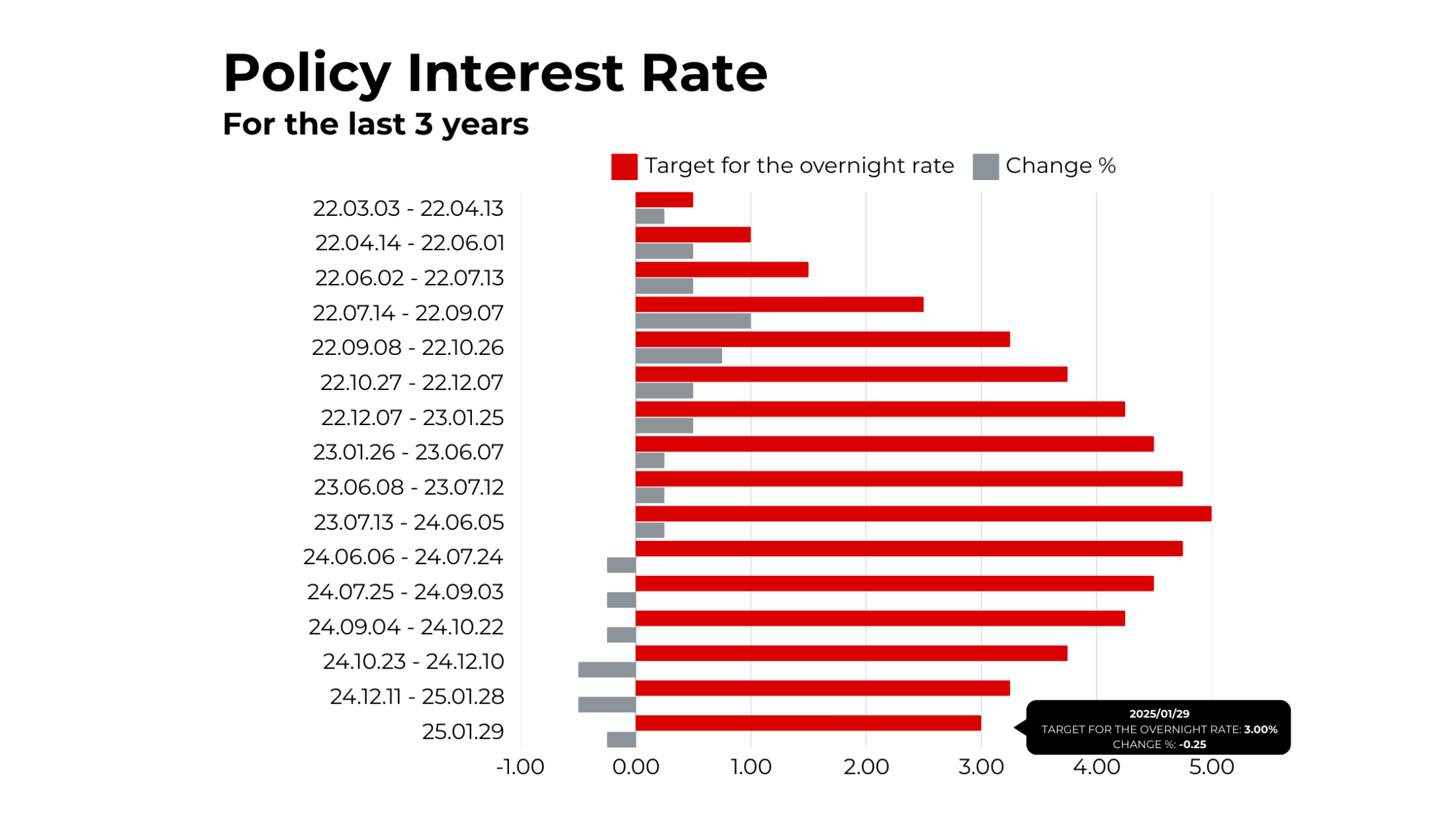

The Bank of Canada just announced a 25-basis-point rate cut, bringing its key policy rate down to 3%. This move marks a significant shift in monetary policy, signaling the end of quantitative tightening and a more accommodative stance to support economic growth. But what does this mean for real estate, mortgages, and the broader economy? Let’s break it down.

Why Did the Bank of Canada Cut Rates?

The decision to lower the policy rate comes amid a mix of economic factors. Inflation is hovering around the 2% target, job growth is stabilizing, and consumer spending is picking up. However, business investment remains sluggish, and global trade uncertainties—especially with potential US tariffs—pose risks to Canada’s economic outlook.

With the economy still operating below its full potential, the Bank has opted for a rate cut to help stimulate borrowing, investment, and overall economic activity. The move also aligns with global trends, as other central banks adjust their policies in response to shifting economic conditions.

How Does This Affect Mortgages?

For homebuyers and existing homeowners, this interest rate cut is welcome news. Banks have also cut their prime rate by 25bps to 5.20% following the Bank of Canada’s lead. Here’s how it impacts you:

Variable-Rate Mortgages: If you have a variable-rate mortgage, you’ll see an immediate drop in your interest rate, leading to lower monthly payments.

Fixed-Rate Mortgages: While fixed mortgage rates are influenced more by bond yields than the Bank of Canada’s policy rate, this rate cut could still contribute to downward pressure on fixed rates.

Mortgage Renewals: If you’re renewing your mortgage soon, this could be an opportunity to secure a more favorable rate and lower your overall borrowing costs.

As borrowing becomes more affordable, we may see increased activity in the housing market as more buyers take advantage of lower rates to enter the market.

Impact on Real Estate Market

Lower interest rates typically encourage more homebuyers to enter the market, increasing demand. Here’s what to watch for:

Increased Affordability

Lower borrowing costs mean reduced mortgage payments, particularly for those with variable-rate mortgages, who will see immediate relief.

Buyers who were previously on the sidelines may find it easier to qualify for a mortgage or afford a higher price point, potentially increasing demand.

Investment Opportunities: For real estate investors, lower rates can improve cash flow and make financing new properties more attractive.

What Should Buyers and Investors Do?

Get Pre-Approved: If you’re considering buying a home, now is a great time to get pre-approved for a mortgage while rates are still low.

Review Your Mortgage Strategy: If you have a variable-rate mortgage, keep an eye on future rate announcements. Fixed-rate holders should evaluate whether switching to a lower rate makes financial sense.

Consider Refinancing: If you have a high-interest mortgage, this could be a good time to refinance and lock in a lower rate, reducing your monthly payments.

Think Long-Term: While rates are lower now, they won’t stay down forever. Plan your real estate investments with a long-term perspective.

Looking Ahead: What’s Next for Interest Rates?

The Bank of Canada will closely monitor economic conditions and inflation trends before making further moves. While another rate cut is possible, much will depend on global trade developments, job growth, and overall economic performance.

The next scheduled interest rate announcement is on March 12, 2025, so stay tuned for updates that could impact your mortgage and real estate plans.

This interest rate cut is a big deal for the Canadian real estate market. Whether you’re a first-time homebuyer, an investor, or a homeowner looking to refinance, now is the time to evaluate your options. If you need expert advice on how to navigate these market changes, feel free to reach out—we’re here to help you make the most informed decisions.

Want to stay ahead of the market? Subscribe to our newsletter for expert insights on real estate and mortgage trends!