As anticipated, The Bank of Canada recently announced a third consecutive reduction to its target overnight lending rate, bringing it down to 4.25%, with the Bank Rate at 4.25% and the deposit rate matching the overnight target at 4.25%. Alongside this rate cut, the Bank is continuing its policy of balance sheet normalization, which aims to reduce the excess reserves built up during past economic interventions. This move is part of a broader effort to stabilize the Canadian economy as global financial conditions shift.

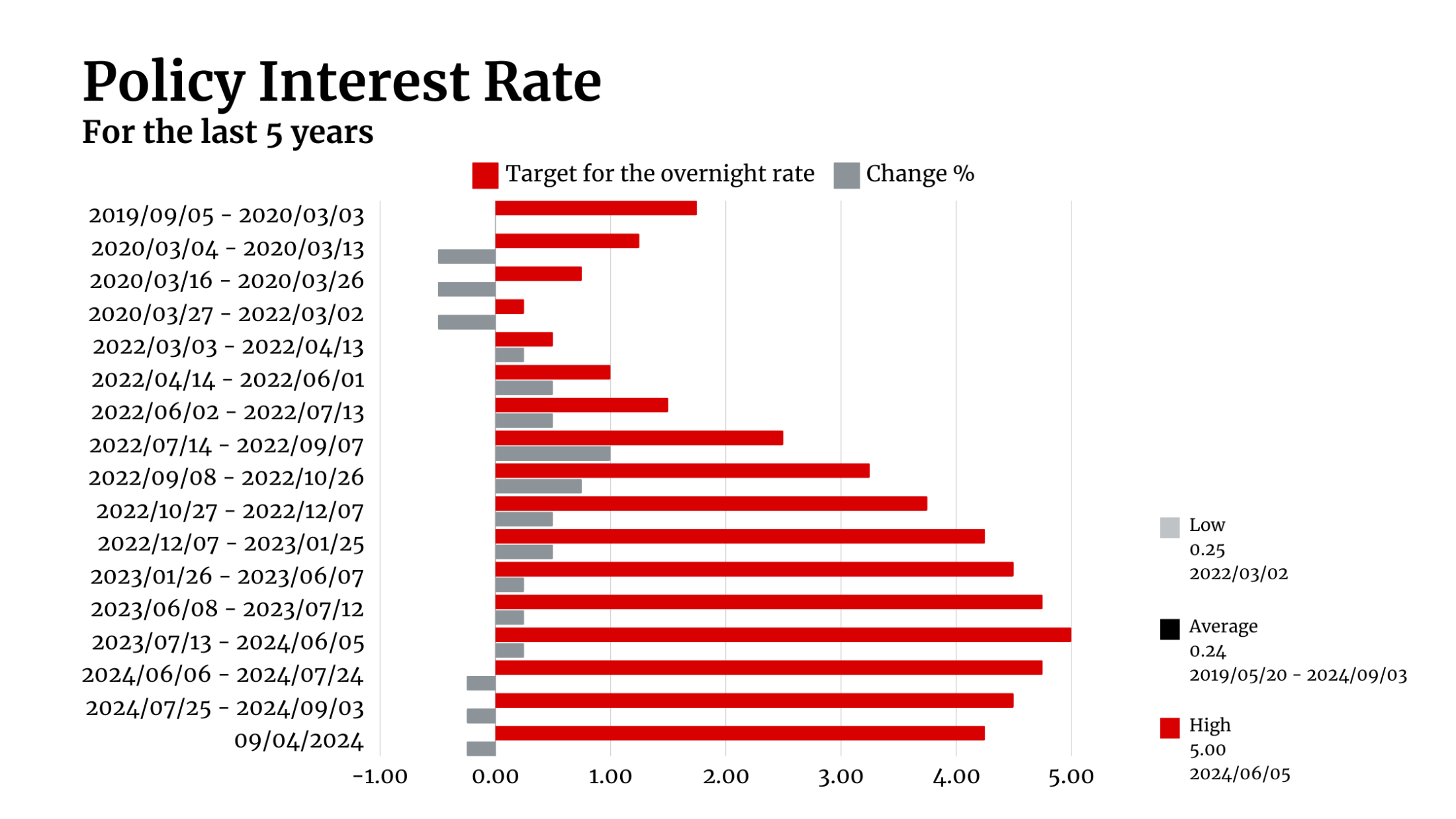

Target for the overnight rate (Past 5 Years)

This chart highlights the changes in the Bank of Canada’s policy interest rate over the past five years, providing a visual understanding of the central bank’s approach in response to evolving economic conditions.

Globally, the economy grew by 2.5% in the second quarter, with stronger-than-expected growth in the U.S. and steady improvement in Europe. China’s growth lagged due to weak demand. Financial conditions have eased, and the Canadian dollar has slightly appreciated. In Canada, the economy grew by 2.1%, driven by government spending and business investment, though recent data shows a slowdown. Inflation has eased to 2.5%, with housing costs still the main driver, though they are starting to decline.

In response, the Bank reduced the interest rate by 0.25% and will continue monitoring trends to ensure price stability for Canadians.

The next overnight rate target announcement is set for October 23, 2024. On the same day, the Bank will release its full economic and inflation outlook, highlighting key risks and projections in the MPR. Stay informed—subscribe to our newsletter for updates.