Posted on

September 23, 2024

by

Paul Lee

Even in Canada's most expensive cities, the country's luxury real estate market isn't cooling down as we head into the fall. The spring of 2024 is seeing growth in high-end property sales across Canada, a trend reported earlier this year by the most recent Royal LePage® Carriage Trade® Luxury Market Report. The first eight months of the year brought increases in almost all cities, save for Vancouver, Toronto, and Halifax which each saw small declines.

So, what does this mean for the luxury market and buyers & sellers in general?

Steady Sales, Reduced Fluctuations

Luxury real estate typically offers more stability compared to the broader market, where price fluctuations are more common. High-end buyers often take their time selecting a home, and sellers are rarely in a hurry to drop their asking prices. This year, cities like Winnipeg, Edmonton, and Calgary have seen the largest gains, driven by strong local interest and buyers from other provinces.

Meanwhile, cities like Toronto experienced a slower start to the year, partly due to the introduction of a municipal land transfer tax in January. However, activity is expected to rise in the fall. Despite this, luxury properties in Toronto continue to be highly sought after, particularly those with convenient access to the city's top amenities like restaurants, parks, and public transit.

Market Drivers

Luxury homebuyers have distinct preferences. They typically seek more than just a property—they’re after specific features such as prime locations or custom-built homes. In certain regions, move-in-ready, fully renovated homes are the most in-demand, while in others, buyers are prepared to navigate rising construction costs to create their ideal living space.

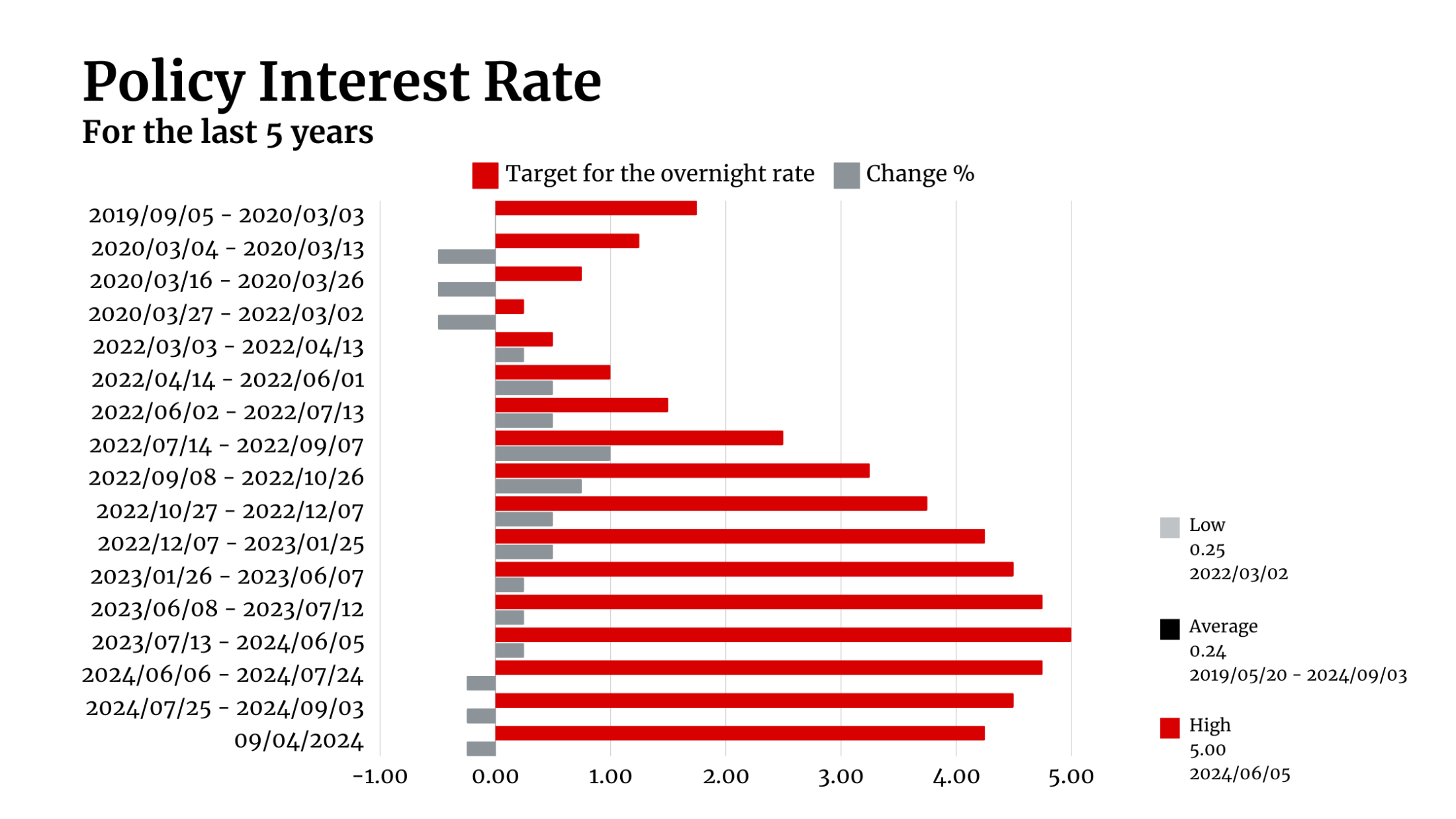

Another key factor fueling the luxury market is economic confidence. High-end buyers are generally less influenced by interest rate changes, as many do not rely on large mortgages. Some make substantial down payments or buy properties outright with cash. Their decisions are typically based on long-term market stability, and currently, they remain optimistic about Canada’s real estate market.

Foreign Buyer Ban: Minimal Impact

The federal government's foreign buyer ban, introduced in 2023 and extended until 2027, was intended to make housing more accessible for Canadians. However, it hasn't significantly affected the luxury market. The majority of high-end buyers are Canadians, and the broader issue in real estate continues to be a lack of available properties, not just within the luxury segment.

What to Expect This Fall?

Looking ahead, the luxury market is expected to stay active. Cities like Calgary, Edmonton, Winnipeg, and Quebec City are predicted to experience continued growth. While markets in Toronto and Vancouver were slower earlier this year, they are likely to gain momentum as interest rates stabilize and economic confidence grows.

Whether you’re looking for a ready-to-move-in home or planning to design your own dream property, luxury real estate remains a sound investment. Buyers in this segment know what they want and are willing to wait, so demand is expected to remain strong.

Toronto’s Luxury Real Estate Market in 2024

In the first eight months of 2024, Toronto’s luxury home prices saw a modest rise of 3.9%, bringing the median price to $5.82 million, even as sales dipped by 5%. The minimum entry point for a luxury home in the city currently stands at $4.75 million.

“Toronto’s luxury market had a soft start to the year as the introduction of the updated municipal land transfer tax came into effect on January 1st. The amended tax saw graduated increases on properties valued over $3,000,000, starting at 3.5 percent and moving upwards. This led to a slower-than-normal spring market, which caused our inventory of available homes for sale to increase,” said Gillian Oxley, sales representative, Royal LePage Real Estate Services Oxley Real Estate. “However, the interesting element of the spring market was the many sellers who did not pull their listings off of the MLS when activity softened. Instead, many sellers chose to keep their homes listed, pushing up the average days on the market.”

Luxury properties in Toronto generally feature 4+ bedrooms, and 5+ bathrooms, and span at least 2,300 square feet. Buyers are patient, waiting for the right deal, although prime areas near transit, dining, and parks remain in high demand.

Oxley anticipates a stronger market in the fall, with further improvement expected in the spring as interest rates ease and buyer confidence returns.

2024 Royal LePage Carriage Trade Luxury Market Report – Data Chart: rlp.ca/2024-Luxury-Market-Report-Chart

Want to stay updated on Canada’s luxury real estate market? Subscribe to our newsletter for the latest trends, market insights, and tips on navigating the luxury property market. Keep posted as the fall market unfolds.

Source: https://www.royallepage.ca/en/realestate/news/luxury-landscape-brisk-activity-expected-this-fall-across-canadas-high-end-real-estate-markets/#_ftn1

.png)

.png)