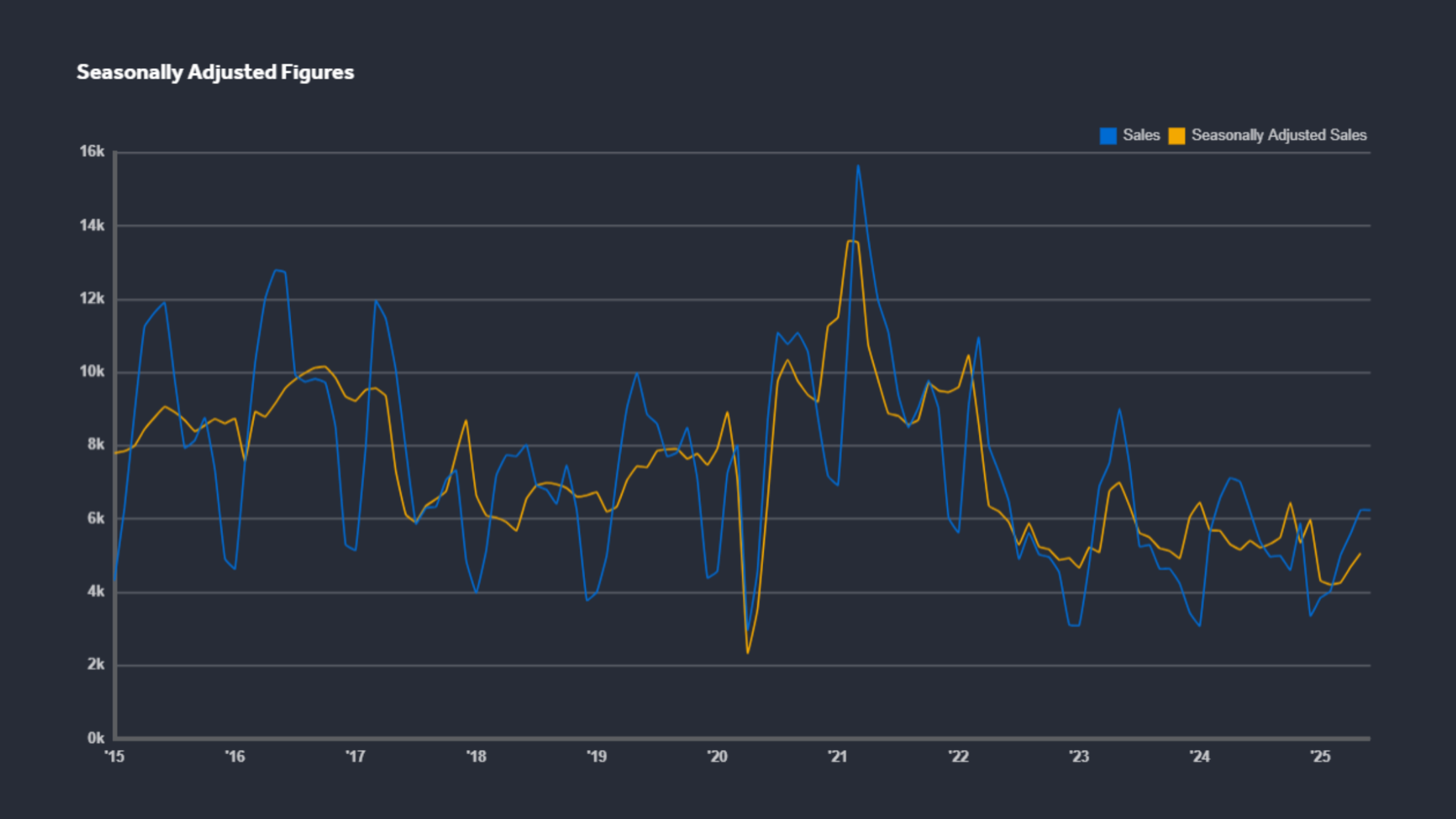

The Greater Toronto Area (GTA) just recorded its best July for home sales since 2021, that has real estate professionals and buyers paying close attention.

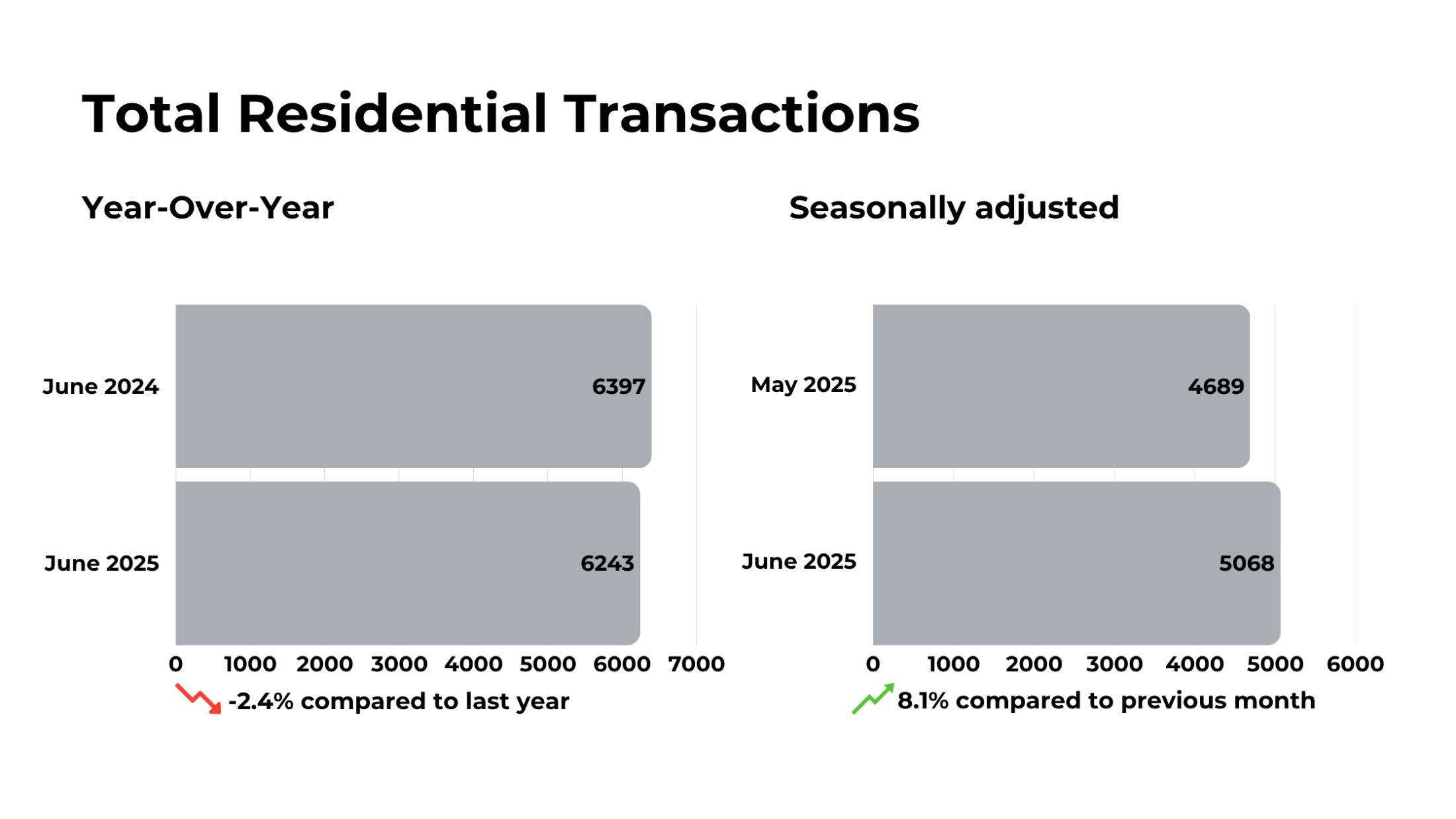

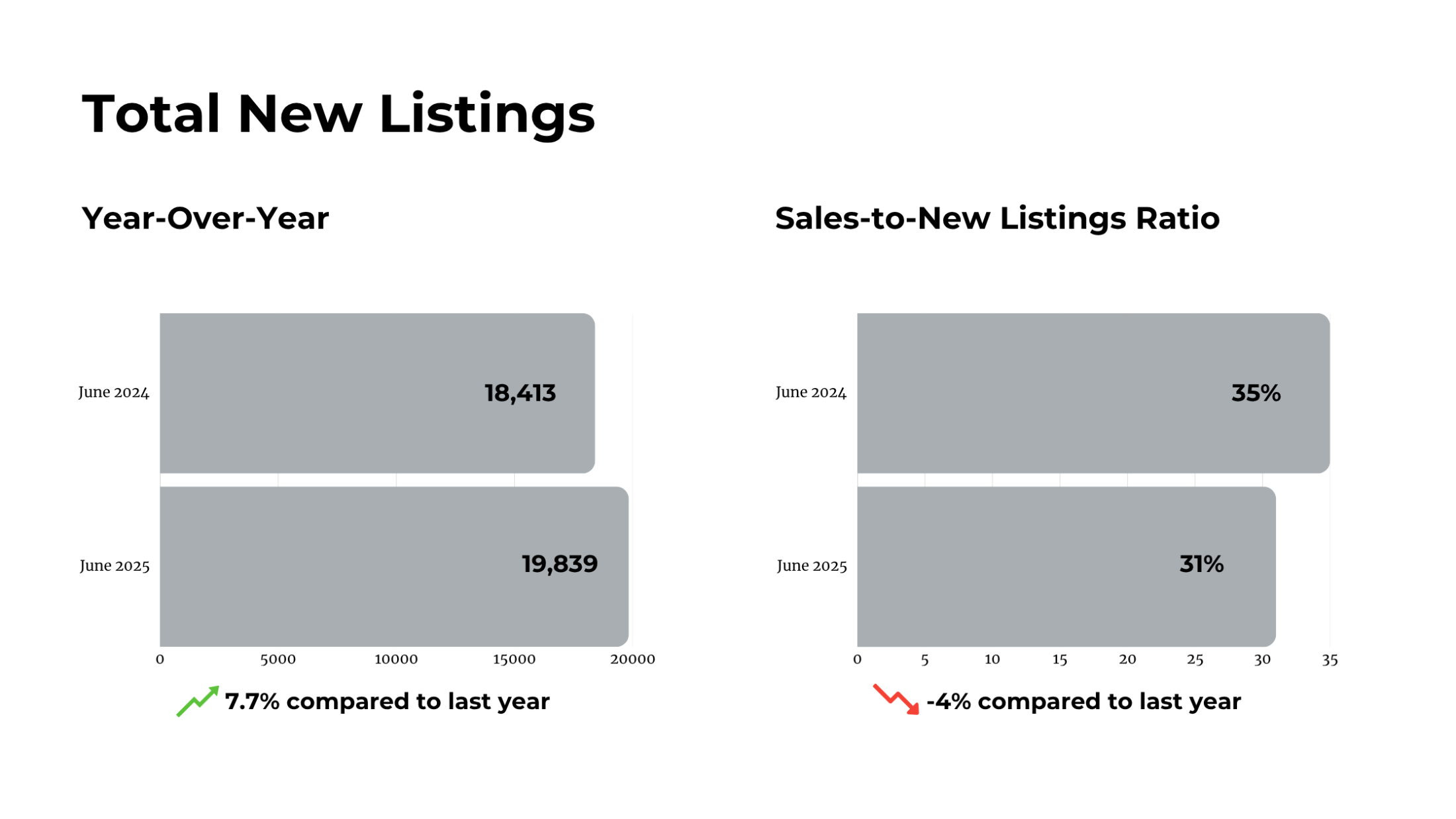

According to the latest figures from the Toronto Regional Real Estate Board (TRREB), a total of 6,100 home sales were reported through the MLS® System in July 2025, representing a 10.9% increase compared to July 2024. New listings were also up by 5.7% year-over-year, reaching 17,613.

As a real estate professional working in the GTA, I’m seeing firsthand how market conditions are shifting. This isn't just a seasonal bump; improved affordability and lower borrowing costs are gradually bringing more buyers back into the market.

What’s Driving the Increase in Home Sales?

TRREB President Elechia Barry-Sproule put it well “Improved affordability, brought about by lower home prices and borrowing costs, is starting to translate into increased home sales. More relief is required, particularly where borrowing costs are concerned, but it’s clear that a growing number of households are finding affordable options for homeownership.”

Let’s break that down:

Home prices have decreased:

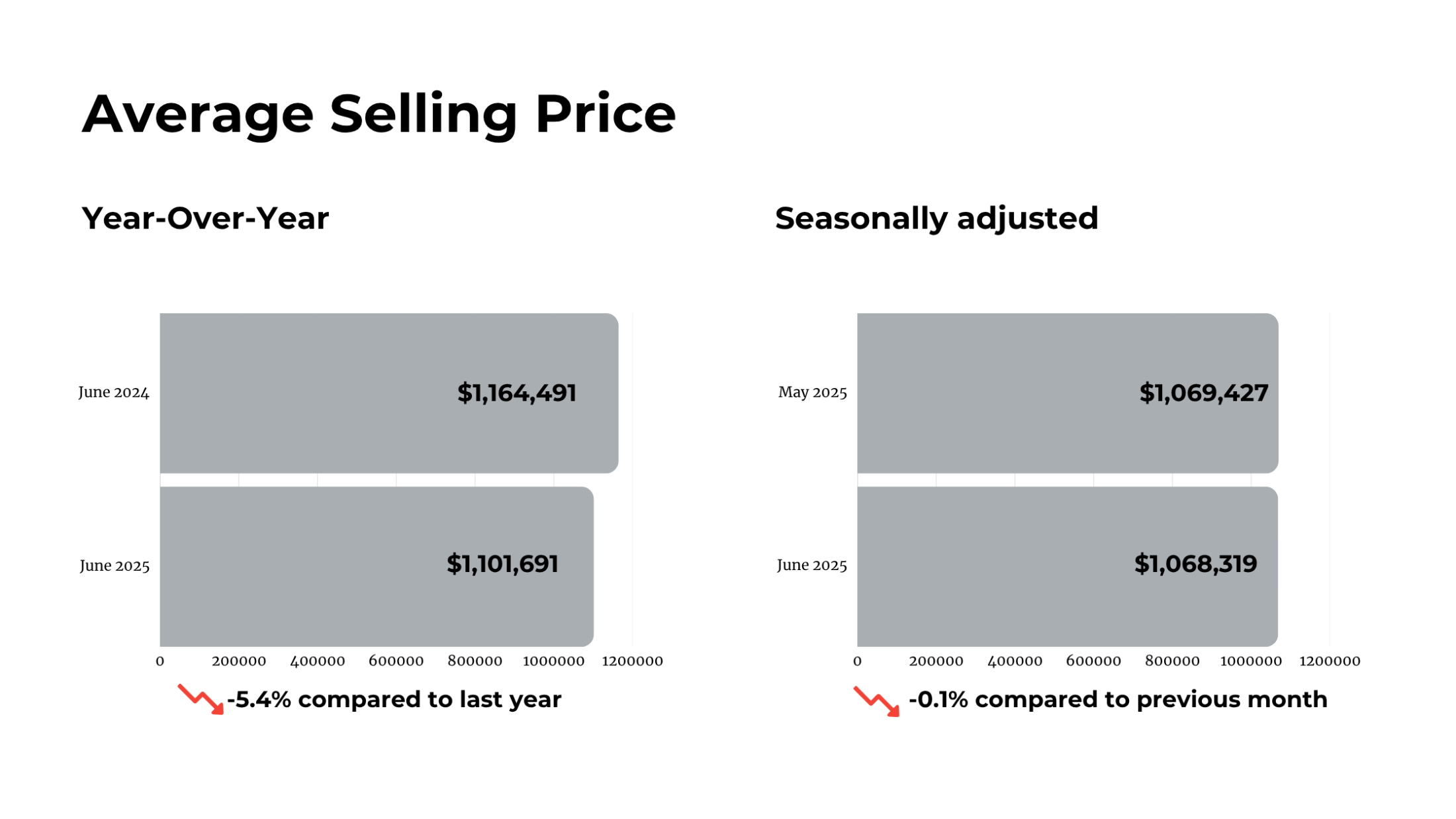

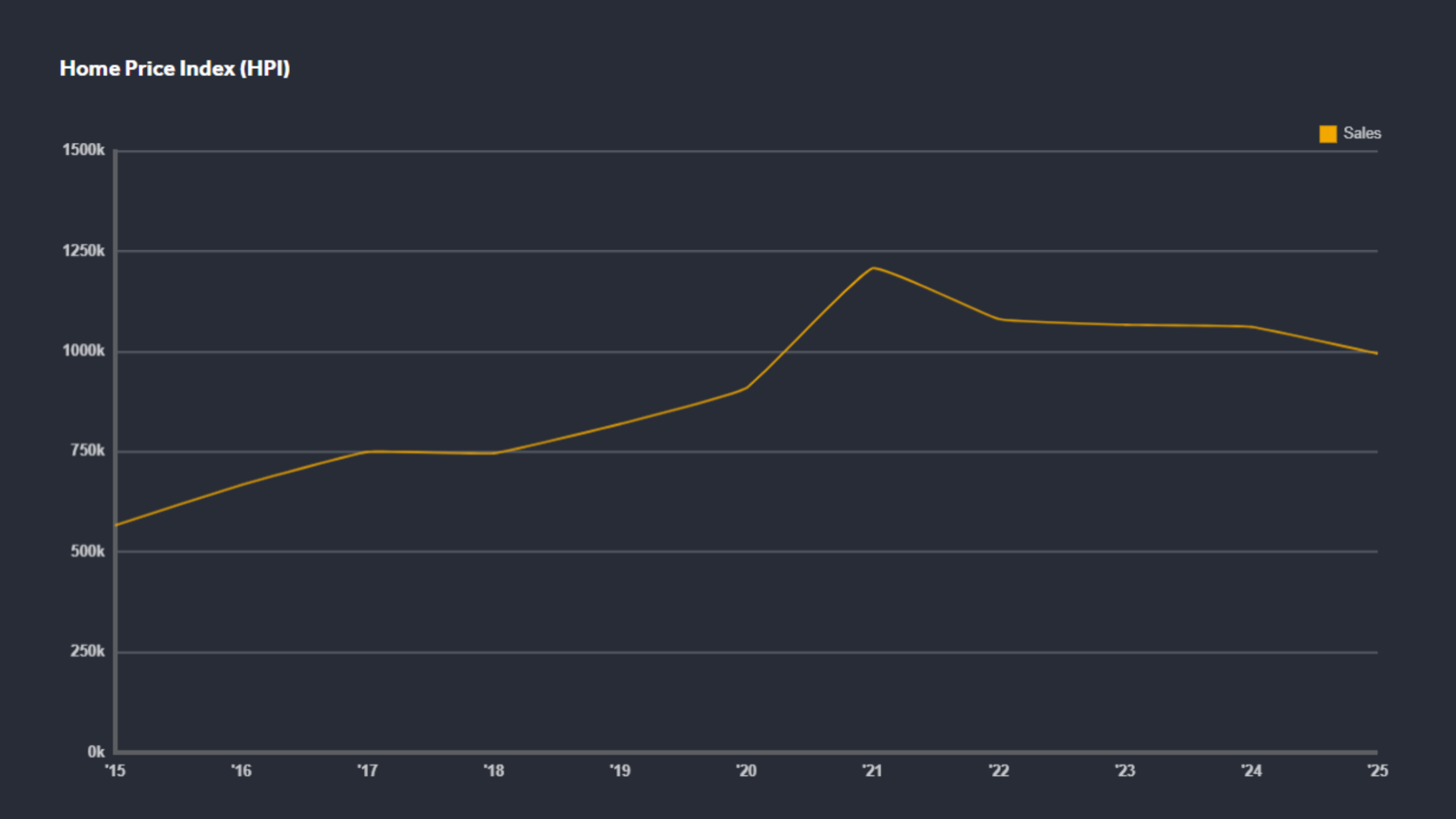

The MLS® Home Price Index Composite benchmark fell by 5.4% year-over-year.

Average selling price sits at $1,051,719, a 5.5% drop from July 2024.

More households can now enter the market, particularly first-time homebuyers and families looking to upsize.

These are significant shifts. After several years of rapidly rising home prices and interest rate hikes, many buyers took a wait-and-see approach. But now, with a bit of breathing room, confidence is starting to return.

A Tighter Market, But Not Overheated

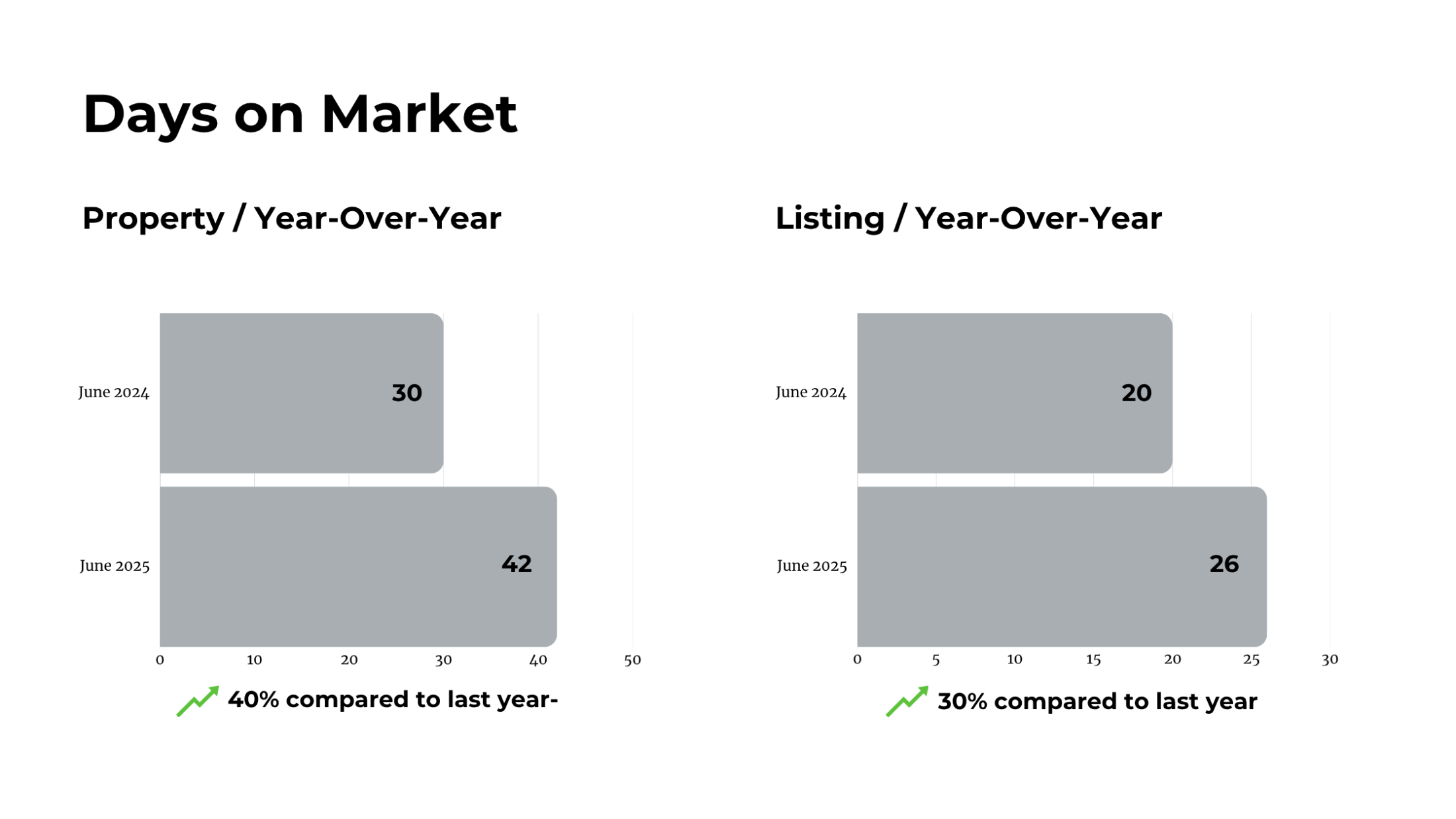

While sales rose sharply compared to new listings, listings did not keep pace a sign of modest tightening in market conditions.

From a seller’s perspective, this could mean a slight advantage: more buyer competition and fewer available properties.

From a buyer’s side, it means more urgency, but also more opportunities, especially in neighborhoods where prices have softened but value remains strong.

On a seasonally adjusted basis, both home sales and new listings rose compared to June 2025, but sales rose at a higher rate, another indicator that demand is outpacing supply just slightly.

Housing as a Catalyst for Economic Growth

In a broader economic context, TRREB Chief Information Officer Jason Mercer highlights how the housing market could play a pivotal role in driving domestic growth “The housing sector can be a catalyst for growth, with most spin-off expenditures accruing to regional economies. Further interest rate cuts would spur home sales and see more spin-off expenditures, positively impacting the economy and job growth.”

This underscores why real estate isn’t just about property it’s tied to construction jobs, legal services, moving companies, furniture sales, renovations, and more. When home sales pick up, the entire ecosystem benefits.

Foreign Buyers and the Truth Behind the Ban

There’s also a misconception circulating that foreign nationals are completely banned from buying residential property in Canada. That’s not entirely accurate.

TRREB CEO John DiMichele clarified: “There are exemptions that allow non-residents to buy property, resulting in spin-off benefits to the economy.”

Foreign buyers can still purchase:

Multi-unit residential buildings (4+ units)

Vacant land or development land

Recreational or rural properties outside urban centres

So, despite restrictions, international interest remains a factor, especially in the luxury and development sectors.

What This Means for You

If you're a buyer looking for your first home, a seller wondering if it's the right time to list, or an investor eyeing the long-term picture, the GTA housing market is showing positive momentum.

Key takeaways:

Prices are more affordable than last year.

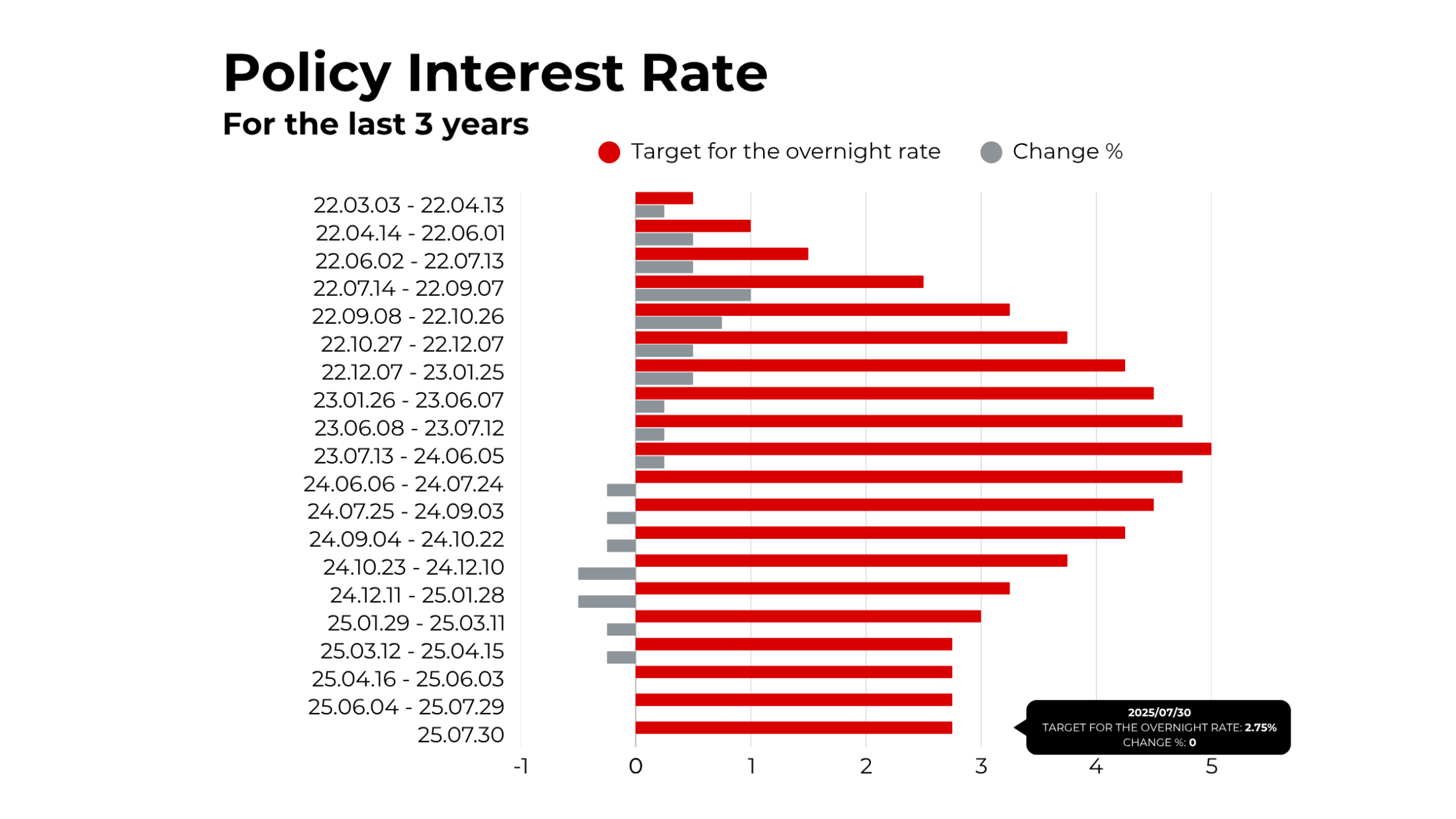

Interest rates are stabilizing.

Demand is returning gradually but steadily.

Market conditions are tightening, but not overheated.

As a real estate professional here in the GTA, I’m keeping a close eye on this evolving landscape. If you’re thinking of making a move, let’s have a conversation about where the opportunities lie in today’s market.

Get professional guidance based on real-time market data and local insights. Contact me today for a no-obligation consultation.