Posted on

October 10, 2024

by

Paul Lee

The September 2024 real estate market in the Greater Toronto Area (GTA) brought some encouraging news for both buyers and sellers. With stable home prices and interest rates starting to ease, more buyers are beginning to take advantage of the current market conditions. Let’s take a closer look at what happened in September, why it’s important, and what it means for you if you’re thinking of buying or selling a home.

Increasing Home Sales

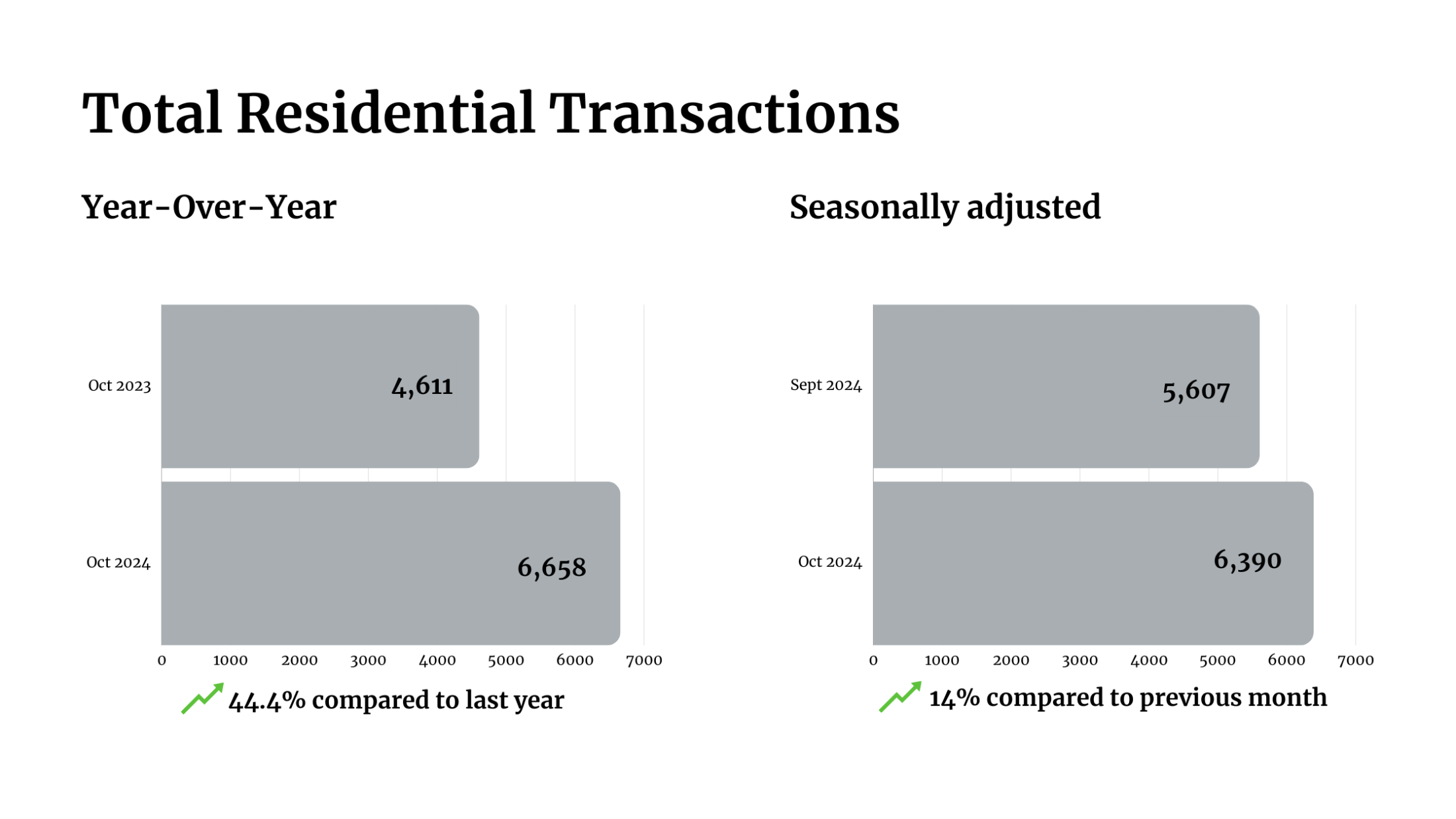

September 2024 saw an increase in home sales compared to the same time last year. According to GTA REALTORS®, 4,996 homes were sold in September, which is an 8.5% increase from September 2023 when 4,606 homes were sold. This boost in sales is partly due to interest rates trending lower, which has made it more affordable for buyers to enter the market.

More Homes, More Choices

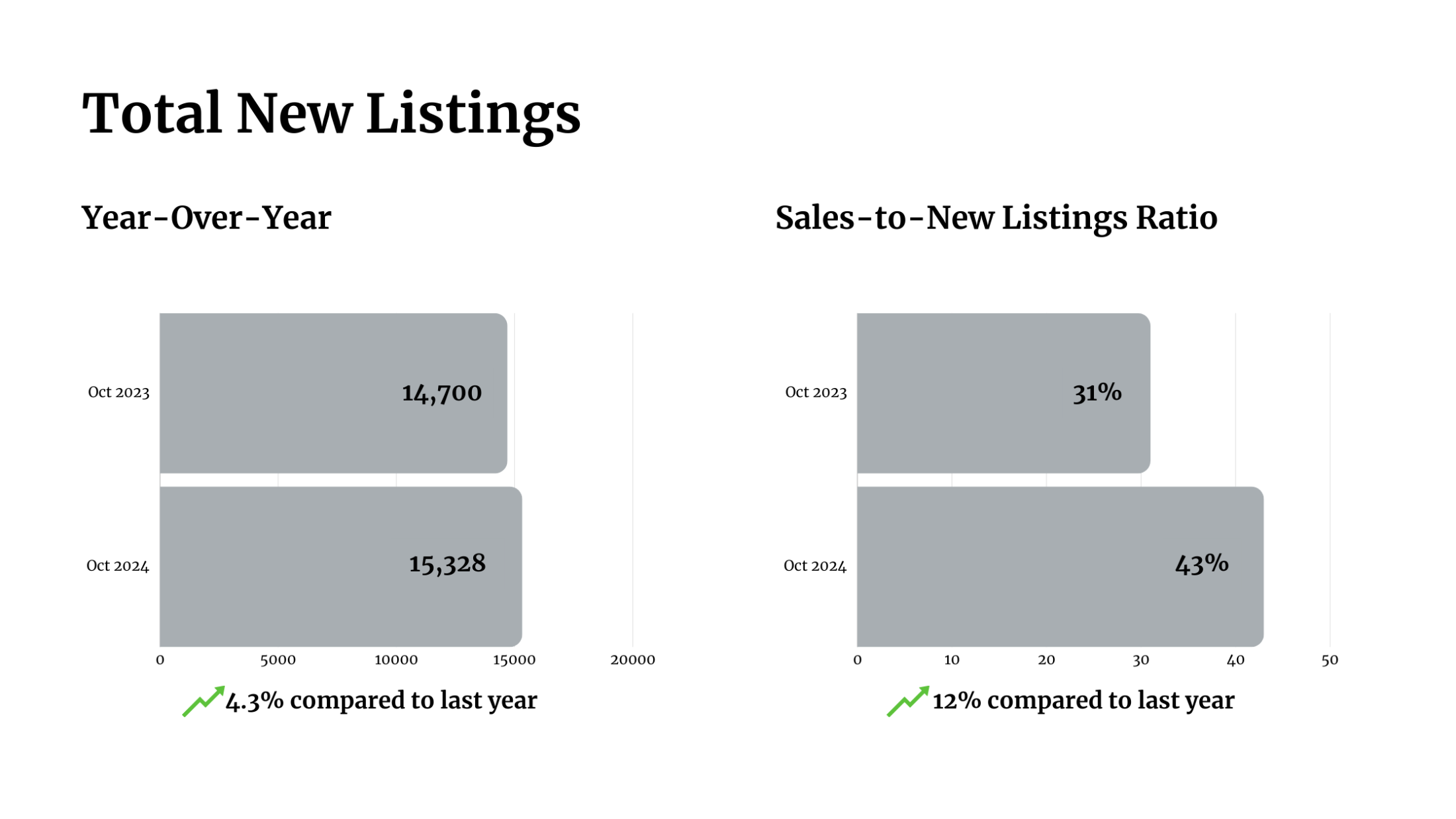

In addition to the rise in home sales, there has also been a significant increase in the number of new listings. In September 2024, there were 18,089 new listings, which is 10.5% more than what we saw in September 2023. This increase in listings gives buyers more options to choose from, which also increases their ability to negotiate prices.

What does this mean for buyers and sellers? For buyers, more homes on the market mean more opportunities to find a home that fits their needs and budget. Sellers, on the other hand, need to price their property strategically according to the market as buyers now have more choices.

What’s Happening with Home Prices?

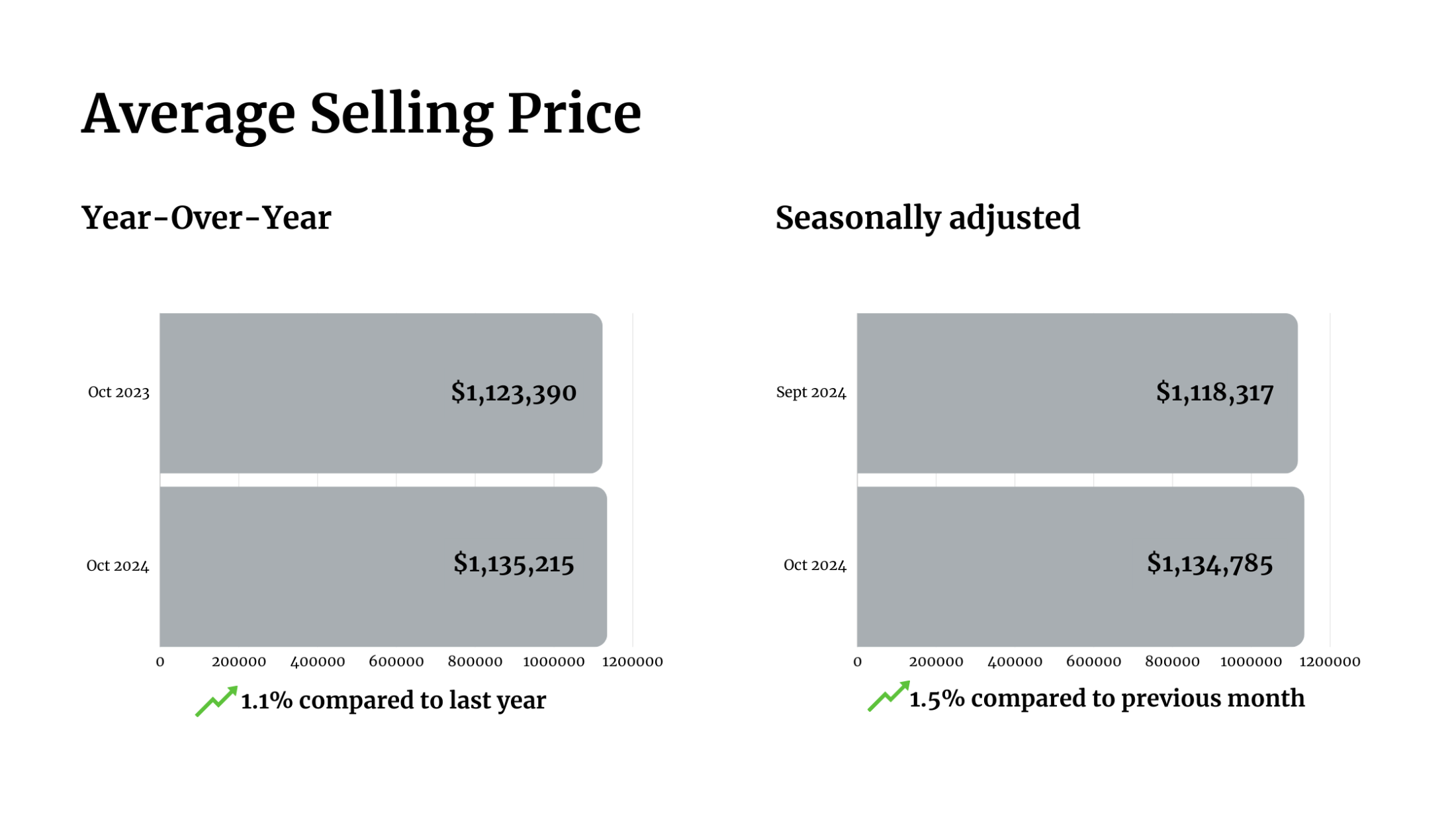

While the number of homes sold and listed increased, home prices have seen a slight dip. The MLS® Home Price Index Composite benchmark was down by 4.6% compared to last year. The average selling price for a home in the GTA in September 2024 was $1,107,291, which is just a 1% decrease from the September 2023 average of $1,118,215.

Interestingly, on a month-to-month basis, the average home price inched up slightly compared to August 2024. This suggests that while prices may have dropped year-over-year, they are beginning to stabilize, which could be a sign that the market is adjusting to the new conditions.

The key points: For buyers, the dip in prices means it’s a great time to start looking for a home, especially in segments like condos and townhouses, which are seeing the biggest price drops. These more affordable housing options are especially attractive to first-time buyers who are looking to enter the market. Sellers, however, may need to adjust their expectations when it comes to pricing, but the overall increase in sales and listings shows there’s still strong interest in the market.

Positive Changes to Mortgage Guidelines

Another factor that will help home sales is the recent changes to mortgage lending guidelines. Over the past month, there have been several adjustments aimed at making it easier for homebuyers to get the possible deal on their mortgage. One key change is that existing mortgage holders can now shop around and change lenders without having to pass the stress test again. This allows for more affordable mortgage renewals, and will create more competition between lenders giving homeowners some breathing room when it’s time to refinance.

Additionally, the introduction of longer amortization periods and the option to insure mortgages for homes priced over $1 million gives buyers more flexibility, especially in a market like the GTA where home prices are much higher than the national average.

What to Expect in the Future

The increase in home sales and listings, along with changes in mortgage guidelines, points to a recovering market. As borrowing costs continue to drop, we can expect more people to enter the housing market, especially first-time buyers and those looking to invest in a second property.

If you’re thinking about buying a home, now might be the perfect time to make your move. With more homes available and rates trending lower, there’s a lot of opportunity. On the other hand, if you’re a seller, you’ll want to keep an eye on market trends and properly positioned in the marketplace when you are ready to list. While prices are slightly lower, they have stabilized and the steady rise in sales suggests there is still strong demand for homes, particularly in the GTA.

The market is changing, and there’s plenty of opportunity for those who are ready to take the next step in their real estate journey. Subscribe to our newsletter to receive monthly updates on GTA market trends.

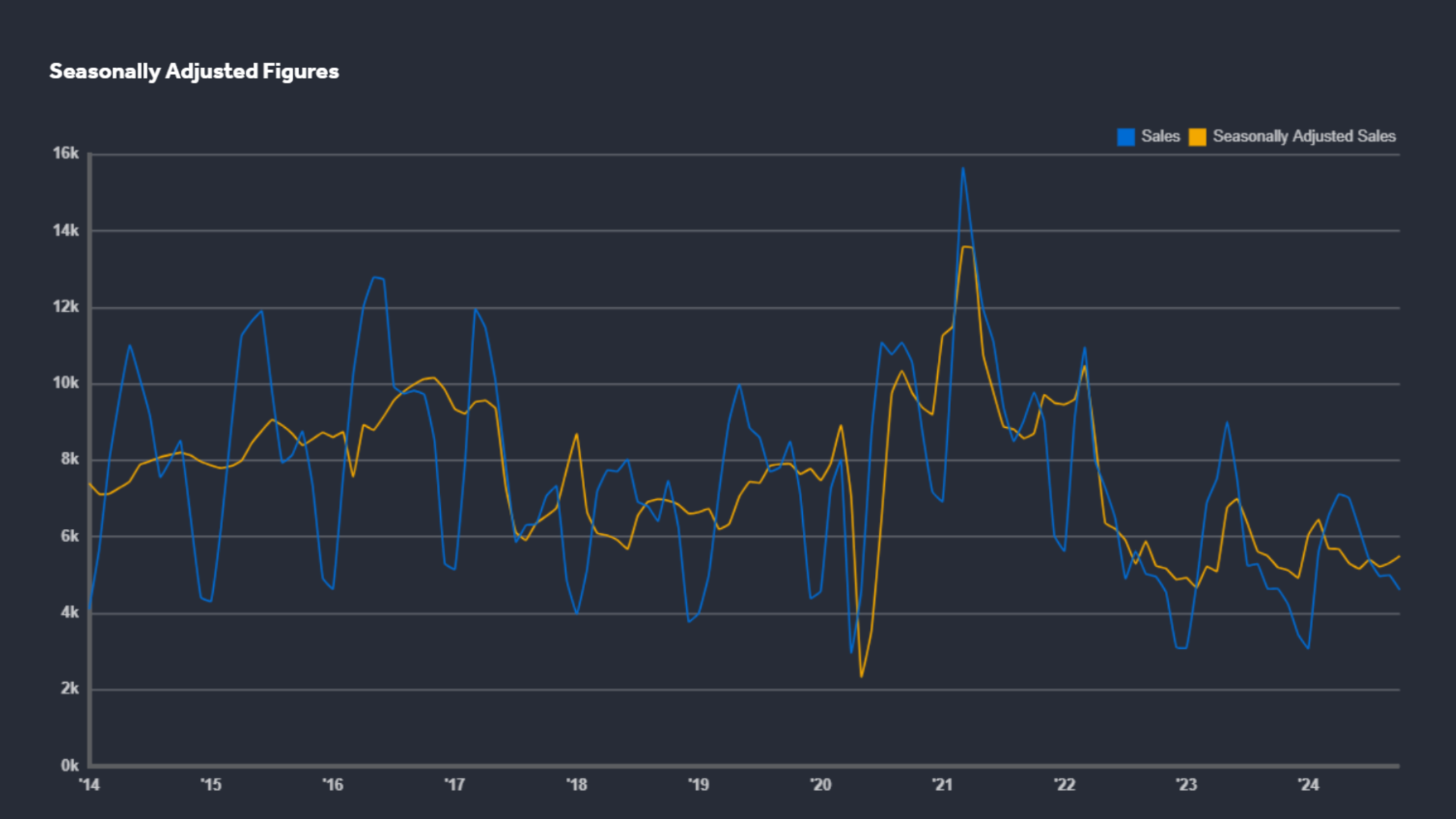

🔗 See the market overview chart here